Fears of an AI bubble are the talk of the town as 2025 comes to a close. When it comes to firms that would feel the impacts of such a development, Nvidia Corporation (NASDAQ:NVDA) is arguably first among equals.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

After all, one can relatively easily draw a straight line between hyperscaler spending and Nvidia’s prospects. If these major tech firms start to slow their roll, NVDA’s share price could be in some serious trouble.

However, while the market sentiment might be starting to lilt, the company doesn’t show any signs of slowing down. The company even plans on improving from its incredible, record-breaking revenues of $57 billion in the third quarter of fiscal 2026, having guided for $65 billion (plus or minus 2%) in sales during the current quarter.

Could this be just the last gasp before the bubble pops? Not according to one investor known by the pseudonym Cash Flow Venue, who disputes any potential parallels to the dot-com crash a few decades ago.

“Nvidia is not a bubble; it’s not overvalued, and I still see its significant potential to not only grow into its valuation further but to keep increasing it as it reaches its next milestones,” declares the 5-star investor.

Cash Flow points to Nvidia’s ability to navigate around and through difficulties during the current year, pointing out that its share price has almost doubled in value since hitting a low point in early April.

Moreover, the company’s valuation blows holes in the bubble worries, according to Cash Flow. While Cisco’s 2-year forward price-to-earnings multiple was close to 100x at the height of the tech stock boom at the turn of the century, the investor points out that NVDA’s forward price-to-earnings is well below this figure. The same holds true for the hyperscalers.

Beyond seeking to disprove that NVDA is encroaching on bubble territory, Cash Flow floats additional rationale to support the bull case. These consist of Nvidia’s expansion of its open-source software, the (potential) re-opening of sales to China, and a “stellar” product roadmap, including the upcoming Rubin and Feynman architecture.

To sum up, NVDA remains one to grab on to as the calendar pages flip, according to Cash Flow Venue.

“I think investors can still expect high double-digit total returns as Nvidia keeps growing its scale and bottom line, as well as cementing its leadership position,” concludes Cash Flow Venue, who rates NVDA a Strong Buy. (To watch Cash Flow Venue’s track record, click here)

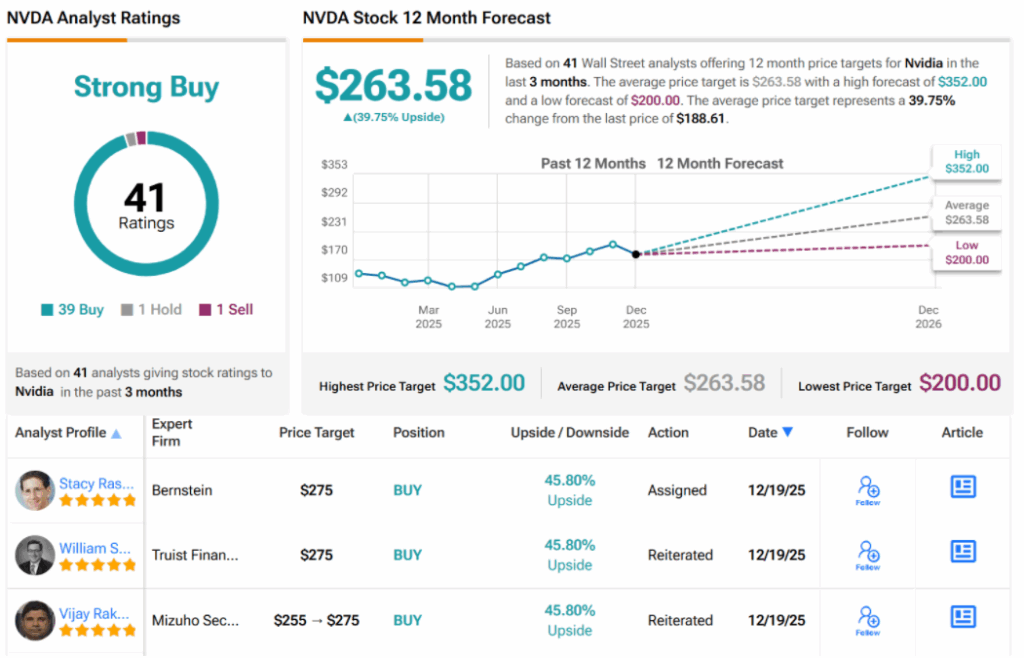

That’s the sense on Wall Street as well. With 39 Buys and just one Hold and Sell, NVDA enjoys a Strong Buy consensus rating. Its 12-month average price target of $263.59 would translate into gains approaching 40%. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.