Shares of athletic apparel maker Nike (NYSE:NKE) sank in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2024. Earnings per share came in at $1.01, which beat analysts’ consensus estimate of $0.84. However, sales decreased by 1.7% year-over-year, with revenue hitting $12.61 billion. This missed analysts’ expectations by $250 million.

Furthermore, NIKE Direct revenues fell 8% to $5.1 billion, while NIKE Brand Digital sales decreased 10%, on a reported basis. Interestingly, investors could have anticipated this drop by simply looking at Nike’s website traffic. As the image below shows, the number of visitors dropped during the most recent quarter. In fact, total estimated visits slipped by 5.74% when compared to the same quarter of last year.

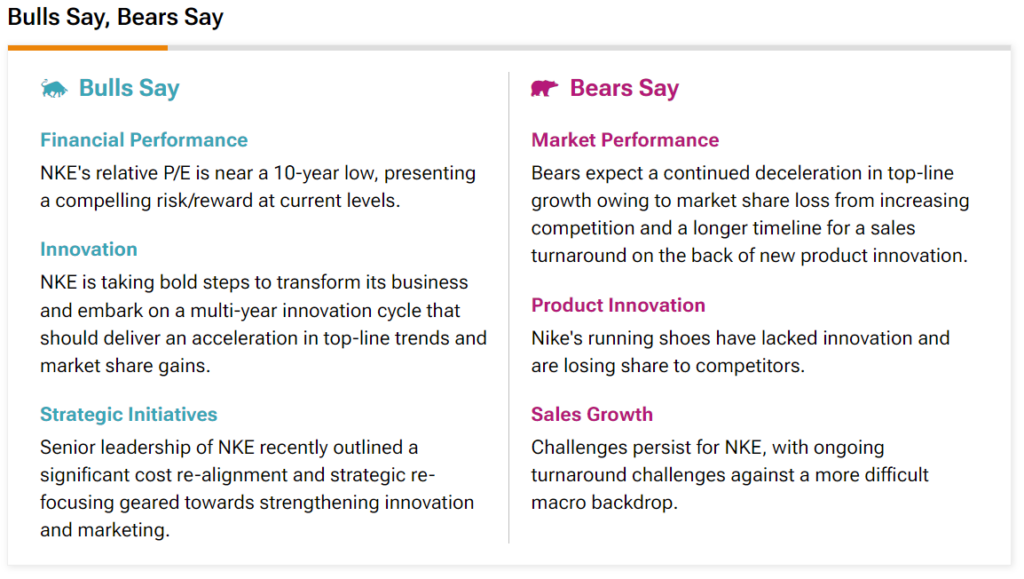

It’s also worth noting that slowing sales growth has been a concern for analysts. In fact, the bearish section of TipRanks’ Bulls Say, Bears Say tool suggests that the company’s sales growth is slowing down amid a difficult macroeconomic backdrop. This isn’t surprising, as people are going to be less willing to spend money on relatively expensive clothes if inflation continues to make everyday essentials a larger part of people’s budgets.

Is NIKE Stock a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NKE stock based on 16 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 15% decline in its share price over the past year, the average NKE price target of $110.55 per share implies 17.17% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.