Shares of Nike (NKE) fell 5% in extended trading after the sneaker giant reported mixed financial results, withdrew its full-year guidance, and announced that it is postponing its planned investor day.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company known for its running shoes and athletic apparel reported earnings per share (EPS) of $0.70, which was well ahead of the $0.52 consensus expectation among analysts. Revenue in what was Nike’s Fiscal first quarter totaled $11.59 billion. That fell short of the $11.65 billion estimated on Wall Street. Sales were down 10% from a year earlier.

Along with its financial results, Nike withdrew is full-year guidance and announced that an investor day it had planned for November has been indefinitely postponed. While the company said the postponement was to give incoming CEO Elliott Hill time to settle into his new role, it did not say if or when the investor day event might be rescheduled. Hill is to take the helm of Nike from outgoing CEO John Donahoe on Oct. 14.

Nike’s Transition and Outlook

Nike did not provide any forward guidance with its Fiscal Q1 financial results. The company said that it withdrew its full-year guidance because of the CEO change. Going forward, Nike said that it will provide guidance on a quarterly basis. The company’s previous guidance, provided in its June earnings report, had called for full-year revenue to be down mid-single digits.

The latest print from Nike comes as the company undergoes a leadership change and strategic shift. Hill, a longtime Nike executive, is coming out of retirement to assume the CEO role. At the same time, Nike is pivoting back to selling its sneakers and athletic gear through wholesalers and retailers such as Foot Locker (FL) after a plan to sell directly to consumers through its own website and stores misfired.

NKE stock has declined 17% so far this year, badly trailing the benchmark S&P 500 index that has gained 20% through nine months of 2024.

Is NKE Stock a Buy?

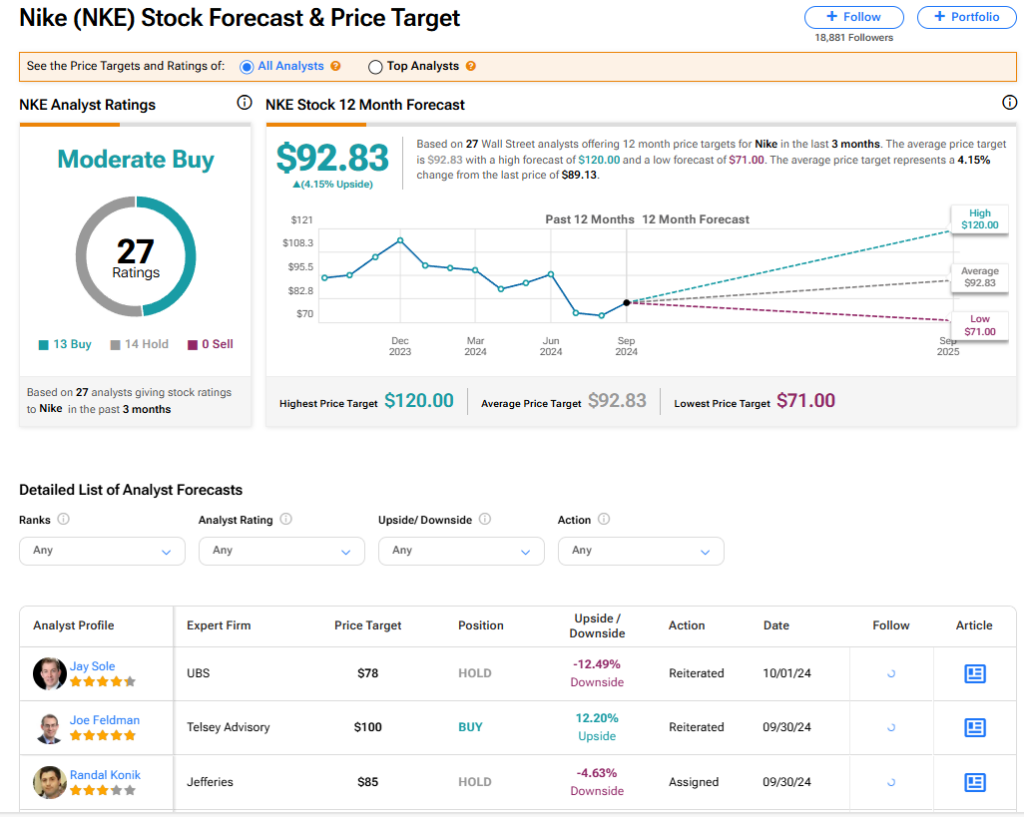

Nike stock has a consensus Moderate Buy rating among 27 Wall Street analysts. That rating is based on 13 Buy, and 14 Hold recommendations made in the last three months. There are no Sell ratings on the stock. The average NKE price target of $92.83 implies 4.15% upside potential from current levels.