Shares of China’s Niu Technologies (NASDAQ:NIU) are trending lower in the pre-market session today after the smart urban mobility solutions provider’s third-quarter topline declined by nearly 20% year-over-year to RMB 927 million. Additionally, the company reported a net loss of RMB 70 million (net loss per American Depository Share of $0.14), compared to a net income of RMB 20.2 million in the year-ago period.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, Niu’s e-scooter sales in China plummeted by 12.4% to 230,455. In tandem, its international scooter sales dropped by 38.4% to 35,468. This marked decline was primarily attributable to cautious spending behavior among consumers in China.

Responding to the changing market dynamics, Niu has repositioned its offerings into two distinct segments, Premium market and Mass-premium market. While the company saw strong demand in the Mass-premium category in Q3, it will be some time before its strategic pivot bears fruit.

Despite challenging market conditions, the company is pursuing global expansion. It recently launched the carbon-fiber kick-scooter and widened its international sales network to 55 distributors across 53 countries. At the end of the quarter, Niu’s total number of franchised stores in China stood at 2,834.

For the upcoming quarter, Niu anticipates revenue to be in the range of RMB 490 million to RMB 612 million, pointing to a year-over-year decline in its top line between 20% and 0%.

What Is the Target Price for NIU Stock?

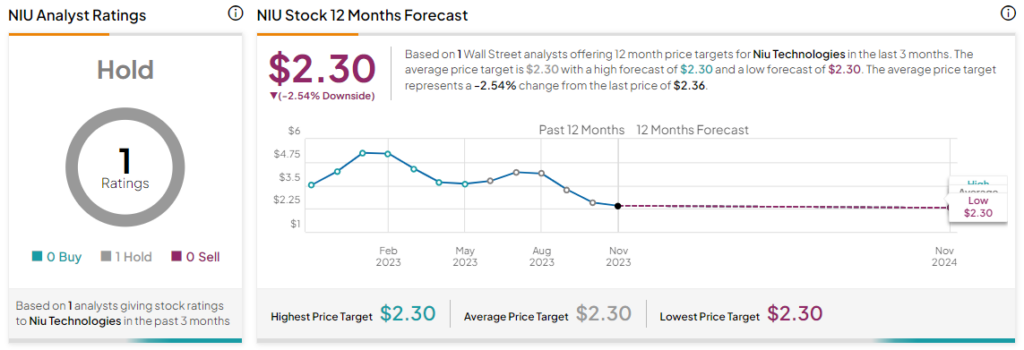

Today’s price decline adds to the nearly 37% value erosion in Niu shares over the past six months. Meanwhile, Citi’s Beatrice Lam, the sole analyst tracking Niu, has reiterated a Hold rating on the stock. The average NIU price target of $2.30 implies a marginal 2.5% potential downside in the stock.

Read full Disclosure