Shares of Japan-based Nissan Motor Co. (JP:7201) dropped after the carmaker cut down its annual operating profit outlook by 70%, marking the second downward revision this year. The company also revealed a major restructuring plan, aiming to cut approximately 9,000 jobs and reduce its manufacturing capacity. The results disappointed investors, leading Nissan shares to drop nearly 7% at the time of writing.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nissan Grapples with Slowdown in U.S. and China

Nissan is struggling with its performance in China and the U.S. and challenging industry conditions.

In China, Nissan is facing strong competition from local brands like BYD Co. Limited (HK:1211), which is attracting consumers with affordable EVs (electric vehicles) with advanced technology. Also, the company lacks strong hybrid offerings in the U.S., unlike its competitor Toyota Motor (JP:6201), which is experiencing high demand for its gasoline-petrol hybrids.

In the second quarter, the company’s operating profit tumbled nearly 85% year-over-year to ¥31.9 billion, with revenue slipping 5% to ¥2.99 trillion.

Nissan Reveals Turnaround Plan to Combat Sluggish Performance

Nissan revealed its turnaround plan to streamline the business to combat its sluggish performance. It plans to cut 9,000 jobs and reduce global manufacturing capacity by 20%. Moreover, the company will reduce its vehicle development lead time to 30 months and strengthen collaboration with partners, including Renault (FR:RNO), Mitsubishi Motors (JP:8058), and Honda (JP:7267).

With this move, it is targeting a ¥300 billion reduction in fixed costs and ¥100 billion cut in variable costs.

Nissan also canceled its interim dividend and retracted its year-end dividend forecast. In addition, the company’s CEO Makoto Uchida announced that he would voluntarily forgo 50% of his monthly salary starting in November, with other executives also agreeing to salary reductions.

Is Nissan a Good Stock to Buy?

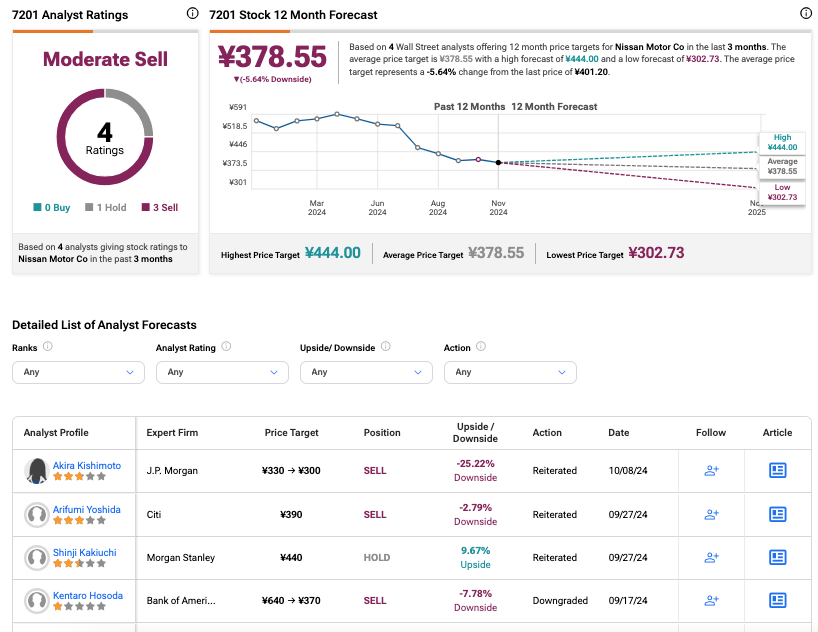

On TipRanks, 7201 stock has been assigned a Moderate Sell rating based on three Sells and one Hold recommendation. The Nissan share price target is ¥378.55, which is 5.64% below the current level.