Chinese stocks remain in focus as investors look for signs of stability in the world’s second-largest economy. Alibaba (BABA) and Nio (NIO) are both set to report earnings, which will offer fresh insight into how China’s e-commerce and electric vehicle sectors are performing amid a still-uneven recovery. In this article, we used TipRanks’ Stock Comparison Tool to compare these two Chinese stocks, Alibaba and Nio, to find the better pick ahead of the upcoming earnings results, according to Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, Alibaba is China’s e-commerce giant with a fast-growing cloud and AI business, while Nio is an electric vehicle maker competing in a crowded EV market.

Is NIO a Good Stock to Buy?

Nio has gained over 63% year-to-date, driven by strong deliveries and renewed optimism about China’s EV recovery. Demand for its new Onvo and Firefly brands has boosted sales, with October deliveries hitting a record 40,397 vehicles, up 92.6% year-over-year and 16.3% from September. The L90 and ES8 models have gained an edge through better pricing and design, while Nio’s expanding lineup and battery upgrades continue to support growth.

Looking ahead, Nio will report Q3 2025 earnings on November 19. Analysts expect a loss of $0.23 per share on revenue of $3.11 billion.

Before the results, Goldman Sachs analyst Tina Hou raised her price target on Nio to $7 from $4.30 and kept a Neutral rating, citing stronger sales from the improved L90 and ES8 models. Hou said Nio plans to launch the L80, ES9, and an updated ES7 in 2026. These models could help the company keep its sales momentum. She also raised her 2026–2030 sales forecast by up to 11%, expecting higher demand and better margins as production grows.

Is Alibaba a Good Stock to Buy?

Alibaba Group Holding (BABA) has been on a strong run, nearly doubling year-to-date, helped by signs of stronger consumer spending in China and improving profitability in its e-commerce division. The company continues to benefit from rising demand for AI and cloud services. Its Q1 FY26 results showed solid momentum, with revenue reaching 247.7 billion yuan ($34.6 billion) and cloud sales climbing 26% year-over-year to 33.4 billion yuan.

Looking ahead, Alibaba will report Q2 FY26 earnings on November 13. Analysts expect earnings of $0.85 per share on revenue of $34.22 billion.

Ahead of the print, Mizuho analyst James Lee reaffirmed his Buy rating on the stock and raised his price target to $195 from $159. Lee said his team’s checks showed strong delivery growth during the summer quarter, helped by better incentives that lifted Alibaba’s e-commerce activity. He also pointed to Alibaba’s growing presence in banking and financial services, noting that its AI-based platform could help it gain more market share.

NIO or BABA: Which Stock is a Better Buy, According to Analysts?

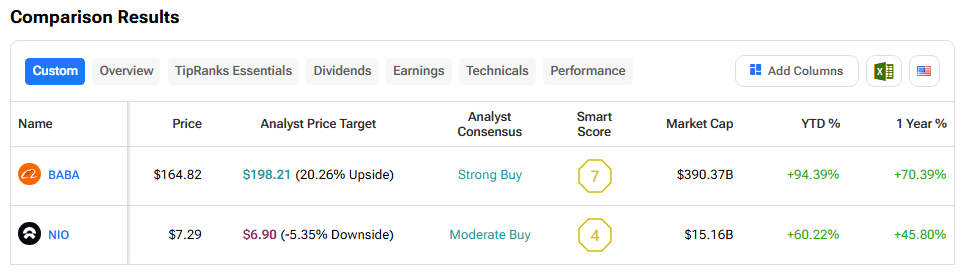

Using TipRanks’ Stock Comparison Tool, we compared NIO and BABA to see which stock analysts favor. Alibaba carries a Strong Buy rating with an average price target of $198.21, implying about 20% upside from current levels. In contrast, Nio holds a Moderate Buy rating and its price target of $6.90 suggests around 5% downside.

Overall, analysts appear more confident in Alibaba’s near-term potential compared to Nio.