NIO’s (NASDAQ:NIO) (HK:9866) share price is right back at levels last seen in June 2020 following a nearly 90% plunge in the Chinese EV maker’s share price over the last three years. Despite its recent promising second-quarter delivery numbers, it may be time for investors to let go of their NIO shares.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

NIO’s Not-So-Bright Prospects

NIO is one of those companies that are highly popular but extremely unprofitable. In the case of NIO, its revenue has grown each year since 2019. However, its bottom line is a sea of red. While its Onvo and Firefly brands offer a glimmer of hope, the company’s negative free cash flow is a point of deep concern.

Another sign of worry is the recent abrupt departure of NIO’s CFO. While NIO appointed another company veteran as its new CFO, a surprise shakeup at the top is hardly ever a good sign for a company. Additionally, the current lackluster macroeconomic picture in China, coupled with fierce price competition in the country, means growth in NIO’s domestic market could be muted. On the other hand, rising protectionist tariffs in Europe could dash hopes of growth from overseas markets for the company.

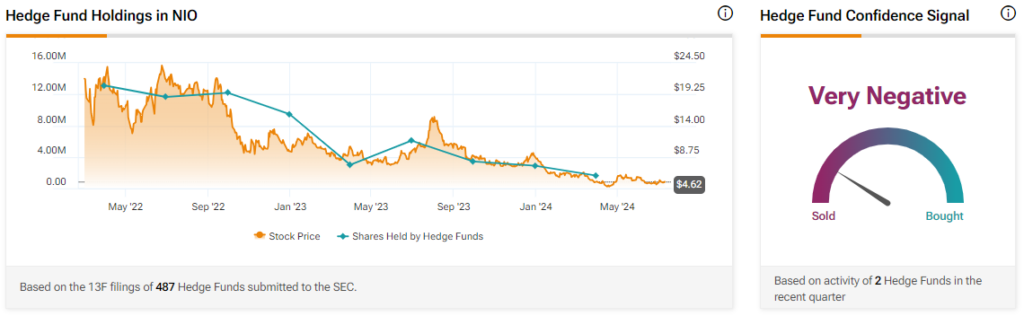

Hedge Funds’ Actions in NIO

It’s no wonder, then, that hedge funds slashed their NIO holdings by about 1.3 million shares in the last quarter. The TipRanks Hedge Fund Activity tool indicates that hedge funds’ confidence in NIO shares remains “Very Negative” at present. Importantly, Ray Dalio’s Bridgewater Associates recently slashed its position in NIO by nearly 48%.

Is NIO a Buy, Sell, or Hold?

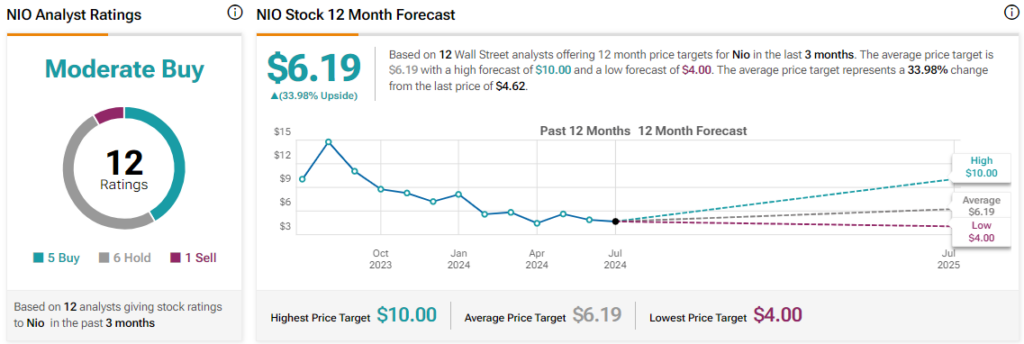

Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average NIO price target of $6.19. However, it may be some time before the company’s share price climbs back to this level.

Read full Disclosure