Chinese EV maker NIO (NIO) is facing overwhelming demand for its officially launched third-generation ES8 SUVs. The vehicle has drawn strong interest as orders have already surpassed its 2025 production capacity, creating a delivery backlog of up to six months, LatePost reported. Despite the strong demand, NIO stock dipped about 6% during Monday’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The seven-seater SUV was launched on Saturday in Hangzhou. The ES8 is priced starting at 406,800 yuan (about $57,000), which is about 27% lower than the second-generation ES8 launch price. Also, Nio is offering a more affordable option of 298,800 yuan available through NIO’s battery-as-a-service rental program.

Demand Surges Past Expectations

Within just 36 hours of launch, NIO reportedly received up to 50,000 locked-in orders for the ES8, well above its stated production cap of 40,000 units for the year. Customers placing orders now are being told to expect delivery delays of 24 to 26 weeks, stretching into 2026.

CEO William Li noted that the ES8’s demand was better than expected. He added that production will ramp up to 15,000 units per month by December, but even that may not be enough to meet demand.

NIO said that all orders placed in 2025 will still qualify for current government tax incentives, even if delivery slips into next year. Also, if delays cause buyers to miss out on subsidies, the company will offer compensation.

Is NIO a Buy, Sell, or Hold?

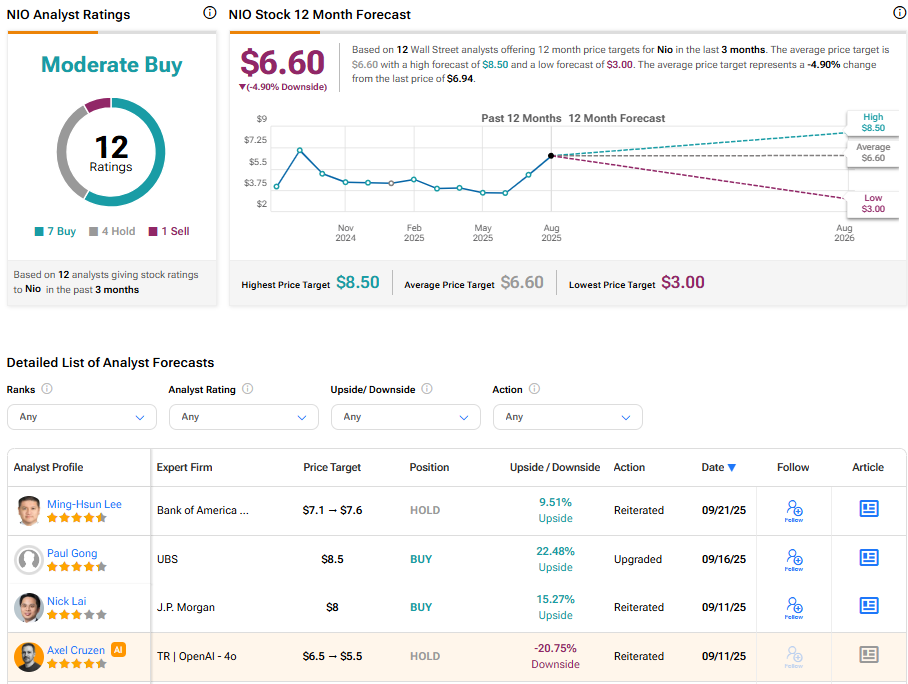

Overall, Wall Street has a Moderate Buy consensus rating on NIO stock, based on seven Buys, four Holds, and one Sell assigned in the last three months. The average Nio stock price target of $6.60 implies 4.9% downside risk from current levels.