Chinese electric vehicle (EV) manufacturer Nio (NIO) is scheduled to release its second quarter Fiscal 2024 results on September 5, before the market opens. Wall Street analysts expect Nio to report sales of $2.45 billion in Q2, up about 96% year-over-year. Meanwhile, analysts expect the company to post a loss of $0.31 per share, lower than the loss of $0.46 in the year-ago quarter, according to TipRanks’ data.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

In terms of share price growth, Nio’s stock has dropped by 55% year-to-date and 63% over the past year, reflecting the company’s disappointing Q1 performance, fierce competition, and market saturation in the EV sector. These challenges have contributed to Nio missing estimates in six of the last nine earnings quarters.

Factors to Consider Ahead of Q2 Results

The drop in the share price has occurred despite Nio’s improving delivery profile. For August, the company delivered 20,176 vehicles, up 4% year-over-year, marking the fourth consecutive month that Nio surpassed 20,000 unit deliveries. Additionally, Nio’s total vehicle deliveries reached 128,100 year-to-date.

Also, according to TipRanks’ Bulls Say, Bears Say tool, bulls are optimistic about the company’s delivery numbers. They expect Nio to deliver 54,000 to 56,000 cars in Q2 2024, indicating a 130-138% year-over-year increase and 80-86% quarter-over-quarter growth, driven by model upgrades. Analysts also pointed out that Nio is preparing to launch its mass-market ONVO sub-brand in September, starting with the L60 smart electric mid-size SUV.

However, bears noted that Nio’s financial performance shows some concerns, with persistent losses and revenue declining to RMB 9.9 billion, down 9% year-over-year. Additionally, Nio faces a new challenge with a 21% tariff imposed in the EU, which could lead to higher retail prices.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can gauge what options traders anticipate for Nio stock right after its earnings report. The expected earnings move is calculated by evaluating the at-the-money straddle of options that are set to expire soon after the announcement.

At present, the Options tool indicates that options traders are predicting a 10.64% swing in either direction for Nio stock.

Is NIO a Buy or Sell?

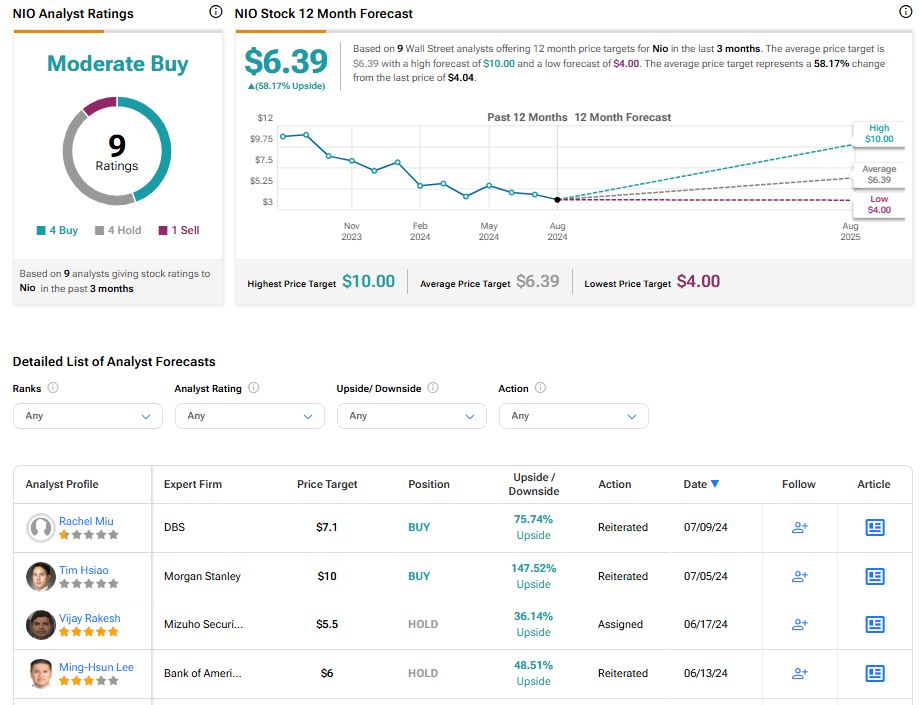

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Nio stock based on four Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. The average Nio price target of $6.39 per share implies 58.17% upside potential.

However, analysts’ views on the stock may change if the company reports a strong Q2 earnings report.