China’s top electric vehicle (EV) makers, including NIO (NYSE:NIO), Li Auto (NASDAQ:LI), and XPeng (NYSE:XPEV), reported solid delivery numbers for May 2024. The notable improvement in deliveries indicates that the demand for EVs is rebounding in the world’s largest auto market.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It’s worth noting that shares of these EV makers came under pressure and have lost substantial value year-to-date amid concerns over a slowdown in EV demand. Moreover, increased price competition led by Tesla (NASDAQ:TSLA) remained a drag. For instance, XPEV stock is down about 43% year-to-date. At the same time, LI and NIO stocks lost about 46% and 41% of their value, respectively.

Adding to the challenges, the U.S. imposed a 100% tariff on EVs imported from China. The high U.S. tariffs on Chinese car imports create a significant barrier for these companies to expand in America. Against this backdrop, let’s look at the May delivery numbers.

May Deliveries

Amid demand concerns, Nio delivered 20,544 vehicles in May 2024, up 233.8% year-over-year. Nio’s deliveries reached 66,217 year-to-date. The company also strengthened its strategic cooperation on battery swapping by partnering with GAC Group and FAW Group, adding to its growing list of strategic partnerships.

Coming to Xpeng, it delivered 10,146 Smart EVs in May, representing a 35% increase year-over-year and an 8% increase over the prior month. XPeng has delivered 41,360 Smart EVs year-to-date, representing a 26% increase year-over-year.

Similarly, Li Auto also recorded a year-over-year and sequential improvement in deliveries. It delivered 35,020 vehicles in May 2024, up 23.8% year-over-year and 36% from the previous month. Li Auto’s cumulative deliveries reached 774,571 by the end of May 2024, with its newly launched model, the Li L6, seeing significant demand.

Which Chinese EV Stock is the Best?

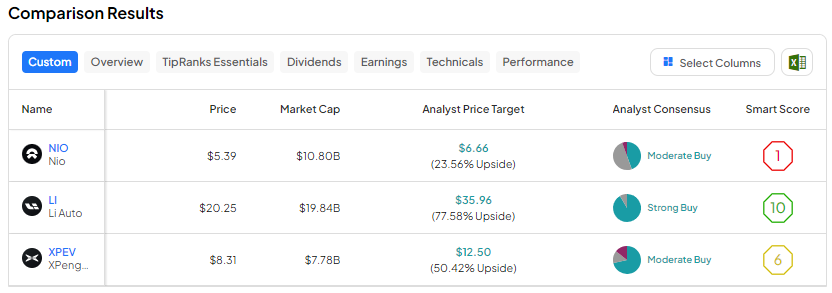

TipRanks’ Stock Comparison tool shows analysts are bullish about Li Auto stock, as represented by a Strong Buy consensus rating. Meanwhile, analysts remain cautiously optimistic about NIO and XPEV stocks.

Moreover, analysts’ average price target suggests that Li Auto stock offers the highest upside potential, about 77.6% from current levels, making it a compelling bet compared to Nio and Xpeng.