Shares of Nike (NKE) are up in today’s trading after the apparel and footwear company launched a new women’s activewear brand called NikeSKIMS in partnership with Kim Kardashian’s shapewear company, Skims. The brand will offer training apparel, footwear, and accessories for women and will be available in select U.S. retail locations and online. This move is part of Nike’s efforts to change up its product line and appeal to a wider range of customers.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Indeed, the company has been focusing on product innovation and returning to its sports roots. In addition, Nike’s new strategy includes appealing to more women, as they make up around 40% of its customers. Evidence of this was seen during the firm’s recent Super Bowl ad, which featured female athletes.

Furthermore, the NikeSKIMS brand will launch globally in 2026 by expanding into more retail locations and the wholesale segment. Skims, which was launched in 2019, is valued at around $4 billion and has seen strong demand for its shapewear. The partnership with Nike is expected to help Skims also reach a wider audience and expand its own product line.

Is Nike Stock a Buy or Sell?

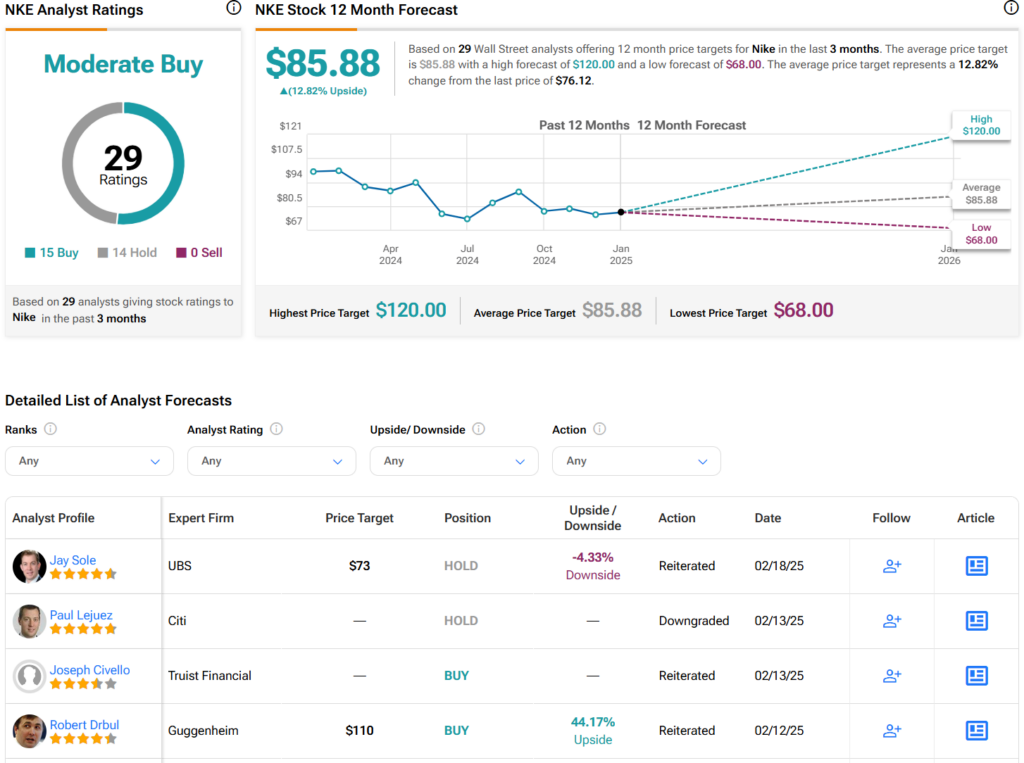

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NKE stock based on 15 Buys and 14 Holds assigned in the past three months, as indicated by the graphic below. After a 31.44% loss in its share price over the past year, the average NKE price target of $85.88 per share implies 12.8% upside potential.