A consortium including New York-based investment management firm Elliott Management is in late-stage talks to acquire Nielsen Holdings PLC (NYSE: NLSN) for around $15 billion including debt, a report published by The Wall Street Journal said citing people with knowledge of the matter.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The sources said Nielsen is conducting financing talks with several banks and a deal could be completed within weeks.

Headquartered in New York, Nielsen provides marketing data collection and analytics services across the world. The company has a debt load of more than $5 billion.

After the news was released on Monday, NLSN stock gained 30.1%. However, it lost almost 1% in after-hours trading to end the day at $22.65.

Wall Street’s Take

Last week, Citigroup (NYSE: C) analyst Jason Bazinet maintained a Hold rating on the stock and lowered the price target to $19 from $21 (17% downside potential).

Additionally, Toni Kaplan from Morgan Stanley (NYSE: MS) reiterated a Sell rating on Nielsen with a $15 price target (34.4% downside potential).

Overall, the stock has a Hold consensus rating based on 1 Buy, 4 Holds and 2 Sells. The average NLSN price target of $20.14 implies 12% downside potential. Shares have lost 13.2% over the past year.

Positive Sentiment

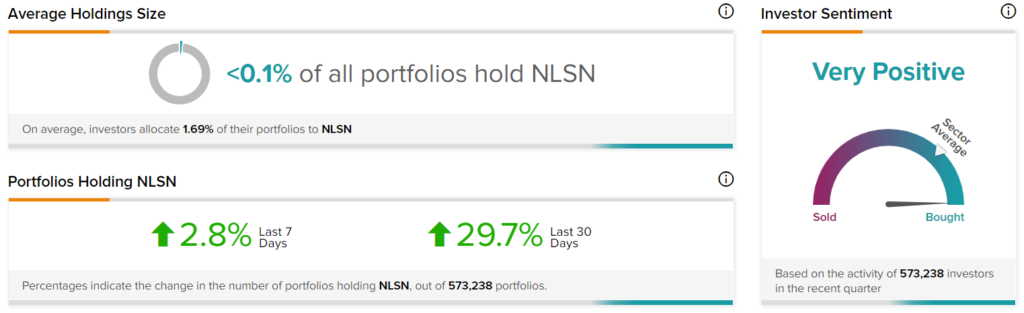

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Nielsen, with nearly 30% of investors on TipRanks increasing their exposure to the stock over the past 30 days.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

DLocal Slips 4.8% Despite Upbeat Q4 Results

Phoenix Generates Record Cash in 2021; Hikes Dividend

Pending WarnerMedia-Discovery Deal, AT&T Outlines Future Growth Strategy