Earlier today, NFI Group (TSE:NFI), a zero-emission mobility solutions provider that sells electric buses and coaches, reported its Q2-2023 earnings results. Please note that all figures are in U.S. dollars unless otherwise stated. The firm posted revenues of $660 million, beating the consensus estimate of about $646 million. Also, NFI saw earnings per share of -$0.46, beating the -$0.49 estimate (-C$0.62 vs. -C$0.66 estimate in Canadian dollars). As a result, the stock finished 2.2% higher today.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The period also saw NFI’s backlog soaring to an unprecedented $6.7 billion. A remarkable 36% of this backlog is reserved for zero-emission buses, showing the company’s commitment to green initiatives, up from 20% in the last year’s corresponding period. NFI also provided insights into its future expectations and strategic financial plans. For Fiscal 2023, the company expects revenue to land between $2.6 billion and $2.8 billion. Also, its adjusted EBITDA is expected to be between $40 million to $60 million.

NFI’s even announced a private placement valued at roughly $38 million (C$50.5 million) in order to raise funds. The company is selling five million shares at a price of C$10.10 per share. With sights set on achieving an adjusted EBITDA figure of $400 million by 2025, NFI aims to wrap up the refinancing initiative by the end of August 2023.

Is NFI Stock a Buy, According to Analysts?

NFI stock has had just one analyst rating assigned to it in the past three months from Cameron Doerksen of National Bank. NFI stock’s price target of C$16 implies 33.7% upside potential.

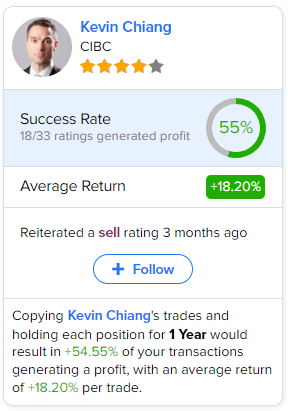

If you’re wondering which analyst you should follow if you want to buy and sell NFI stock, the most accurate analyst covering it (on a one-year timeframe) is Kevin Chiang of CIBC, with an average return of 18.2% per rating and a 55% success rate. Click on the image below to learn more.