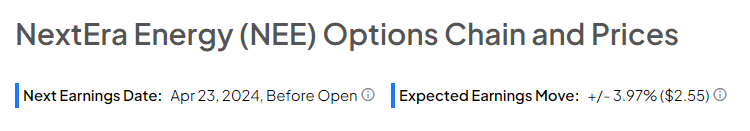

Utility and renewable energy provider NextEra Energy (NYSE:NEE) is scheduled to report its first-quarter results before the market opens on April 23. Ahead of the results, several analysts have expressed optimism about the company’s performance, fueled by increased demand for renewable energy sources. Additionally, NEE boasts an impressive track record of exceeding analyst estimates for 15 consecutive quarters, raising expectations for another potential beat.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

NEE stock has gained more than 14% in the past three months and outperformed the 2.4% rise in the S&P 500 Index (SPX).

NEE – Q1 Expectations

Wall Street expects NextEra to report sales of $6.05 billion in Q1, up about 35% year-over-year. The company’s top line is expected to expand, driven by healthy demand for renewable energy and battery storage solutions.

Turning to earnings expectations, Wall Street analysts expect NEE to post earnings of $0.75 a share in Q1, down about 11% year-over-year.

Analysts Weigh In

Ahead of the company’s Q1 results, two Top-rated analysts maintained a Buy rating on NextEra stock. BMO Capital’s James Thalacker is optimistic about the company’s plans to double renewable capacity by 2025 and investments in the green hydrogen energy business. His price target of $68 implies an upside of 5.8% from the current level.

Furthermore, J.P. Morgan analyst Jeremy Toney is bullish about the company’s future prospects. He assigned a price target of $76 on the stock, which reflects an upside potential of 18.2%.

Is NEE a Good Stock to Buy Right Now?

Overall, Wall Street is cautiously optimistic about the stock. NextEra has a Moderate Buy consensus rating based on nine Buy, three Hold, and one Sell recommendations. The analysts’ average price target on NEE stock of $70.08 suggests an upside of 9%.

Insights from Options Trading Activity

TipRanks presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 3.978% move on NEE’s earnings, compared with the previous quarter’s earnings-related move of 1.7%.

The anticipated earnings move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Concluding Note

NextEra benefits from its strong position within the utility sector, which is known for its stability and consistent cash flows. Moreover, NextEra’s robust balance sheet supports investment in strategic growth initiatives. NEE’s commitment to grow dividends by at least 10% annually until 2026 is also encouraging.

In addition, bullish analysts’ sentiments instill confidence in the stock ahead of the Q1 earnings report.