Shares of utility company NextEra Energy (NYSE:NEE) are up today after it reported earnings for its first quarter of Fiscal Year 2024. Adjusted earnings per share came in at $0.91, which beat analysts’ consensus estimate of $0.80 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, sales decreased by 14.7% year-over-year, with revenue hitting $5.73 billion. This was $750 million below expectations.

Looking forward, management now expects adjusted EPS for FY 2024 to be in the range of $3.23 to $3.43. For reference, analysts were expecting an EPS figure of $3.40.

Is NextEra a Buy, Sell, or Hold?

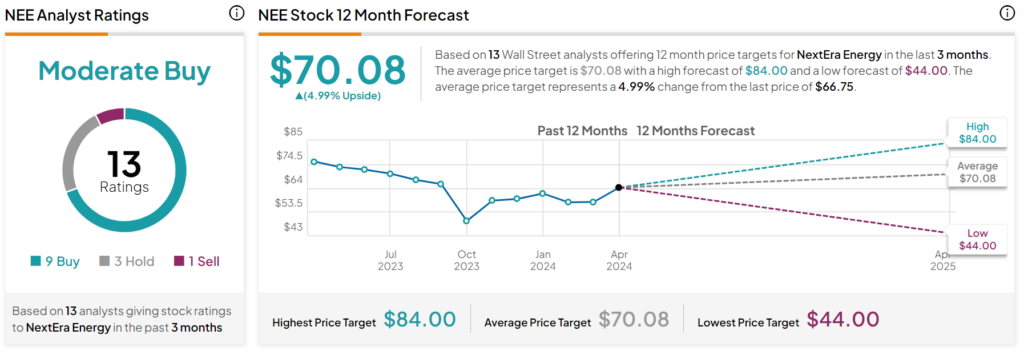

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NEE stock based on nine Buys, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 12.5% decline in its share price over the past year, the average NEE price target of $70.08 per share implies 5% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.

NEE also pays out a quarterly dividend, which yields 3%. This is in line with the utilities sector (XLU) average.

Is NEE the Right Stock to Buy for Passive Income?

Before you hurry to invest in NEE, think about the following:

TipRanks’ team has built a Smart Dividend Stock Portfolio for investors, and NextEra Energy is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant passive income for years to come.

See Smart Dividend Portfolio >>