Conservative cable network Newsmax (NYSE:NMAX) exploded onto the public markets on Monday, closing at $83.51—up a staggering 735% from its $10 IPO price—after a day of trading halts, speculation, and election-fueled enthusiasm.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Volatility Reigns as NMAX Opens Strong

The stock opened at $14 and quickly shot higher, triggering more than a dozen volatility halts before settling at $82.25 by market close. In after-hours trading, shares tacked on another 1%. In total, over 6 million shares changed hands—an eye-popping figure given the relatively small offering.

Newsmax raised $75 million through the sale of 7.5 million Class B shares under a Regulation A+ offering, a more streamlined alternative to a traditional IPO. CEO Christopher Ruddy, who retains 81% voting control thanks to a dual-class structure, called the listing a “transformational moment” for the company.

Trump Momentum and Retail Frenzy Drive Demand

The IPO comes as conservative media experiences a resurgence tied to the return of President Donald Trump. Newsmax, now the fourth most-watched cable news channel, has benefited from Trump’s public support and the perception that it could rival Fox News in the current political climate.

For many retail traders, the stock has become a short-term momentum play—fueled by limited share availability (known as a low float), constant media buzz surrounding the IPO, and the appeal of a well-known founder who’s now reportedly worth $3.3 billion.

Newsmax’s Financials Show Growth — But Losses Mount

Newmax’s revenue for the first half of 2024 jumped to $79.8 million, up from $53.3 million a year prior. But losses also widened to $55.5 million—raising questions about long-term profitability. Moreover, Newsmax recently raised another $225 million in a preferred share offering to fuel expansion.

Investor Caution Is Still Warranted

Despite Monday’s rocket ride, analysts warn the excitement may be short-lived. Dual-class governance, concentrated ownership, and ongoing net losses could limit institutional interest. The post-IPO float remains tight, which may continue to fuel volatility.

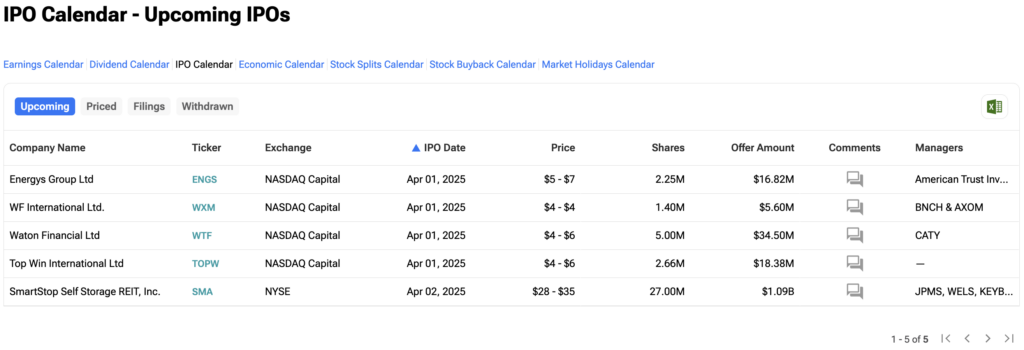

Investors looking to track the latest IPOs can use TipRanks’ IPO Calendar to stay ahead of the curve, monitor debut performance, and uncover potential opportunities before they hit the mainstream radar.