In the wake of new U.S. restrictions on AI investments in China, AI-focused ETFs could experience shifts as investors turn attention toward U.S.-based tech firms. On October 28, the Biden administration finalized rules curbing U.S. investments in China’s AI sector, citing concerns over China’s advancement in military technology, according to Reuters. As the U.S. doubles down on AI development at home, AI-focused ETFs with a domestic tech slant might be primed for growth.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ARKW’s Position in U.S. AI Growth

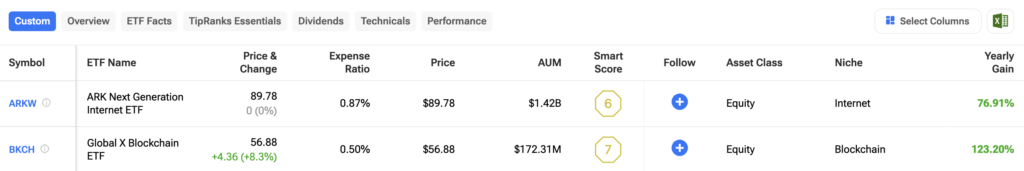

ARK Next Generation Internet ETF (ARKW) has already been zeroing in on U.S.-based AI and internet technology. ARKW’s diverse portfolio includes companies with strong AI initiatives, like NVIDIA and Alphabet, who are laser-focused on growth within the U.S. market. With the U.S. now emphasizing domestic tech advancements, ARKW’s selection could benefit from increased investments and strategic opportunities on home soil.

ETFs Tied to Blockchain See AI Advantages

AI and blockchain are increasingly linked, and Global X Blockchain ETF (BKCH) may have a foot in the door. Blockchain’s future looks intertwined with AI-driven efficiency, and with U.S.-based firms leading innovation, this ETF may benefit from increased investor confidence in domestically controlled technologies.

China Restrictions Open U.S. Tech for ETFs

The U.S. government’s AI restrictions reflect a significant push to control tech advancements, especially those with military applications. While this limits certain international investments, it drives renewed interest in domestic tech. “There’s a shift towards home-grown solutions,” Bloomberg reports, which could fuel these ETFs with more robust growth prospects at home.

Potential for U.S.-Focused AI ETFs to Surge

With new U.S. policies firmly in place, ETFs tied to AI, internet, and blockchain technologies—especially those focused on domestic companies—could be positioned for gains as tech investments look inward. If these policies spur growth in U.S.-centered innovation, ARKW, BKCH, and similar ETFs may soon reflect this renewed emphasis on homegrown tech.

Using TipRanks’ ETF Comparison tool, investors can assess which ETF aligns best with their individual needs.