Despite a couple of new moves—one connected to the C-suite and another connected to a court case involving the C-suite—BlackBerry (TSE:BB) (BB) investors were pretty ambivalent about BlackBerry stock in Monday morning’s trading session. Shares of the cybersecurity company were ultimately down modestly in Monday morning’s trading.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

First, BlackBerry received good news in court, as a U.S. judge—Sallie Kim—tossed out three claims against the company’s CEO, John Giamatteo. One claim was that Giamatteo was at least somewhat responsible for creating a “hostile work environment.” However, there was a lack of evidence to suggest that Giamatteo’s behavior was “…pervasive or severe.”

Issues of discrimination in pay, as well as issues of wages being owed, were also tossed out, as the plaintiff involved in the case failed to even state a claim on those points. Though Kim ultimately agreed with BlackBerry on most points, Kim was willing to allow the plaintiff to modify the complaint and try again another time, which means BlackBerry isn’t quite out of the woods yet.

C-Suite Shakeup

Meanwhile, BlackBerry staged a roster move, bringing in a new chief financial officer (CFO) to replace outgoing officer Steve Rai. Taking the slot is Tim Foote, who comes in as BlackBerry is looking to branch off its cybersecurity operations from its Internet of Things (IoT) operations to improve focus.

Rai, for his part, is departing the company “to pursue other opportunities,” a classic statement if ever there was one. Foote, meanwhile, previously served as CFO of the cybersecurity division, which means branching into CFO for the whole operation is a reasonable progression. More work, maybe, but not exactly unfamiliar ground for him.

Is BlackBerry Stock a Buy or Sell?

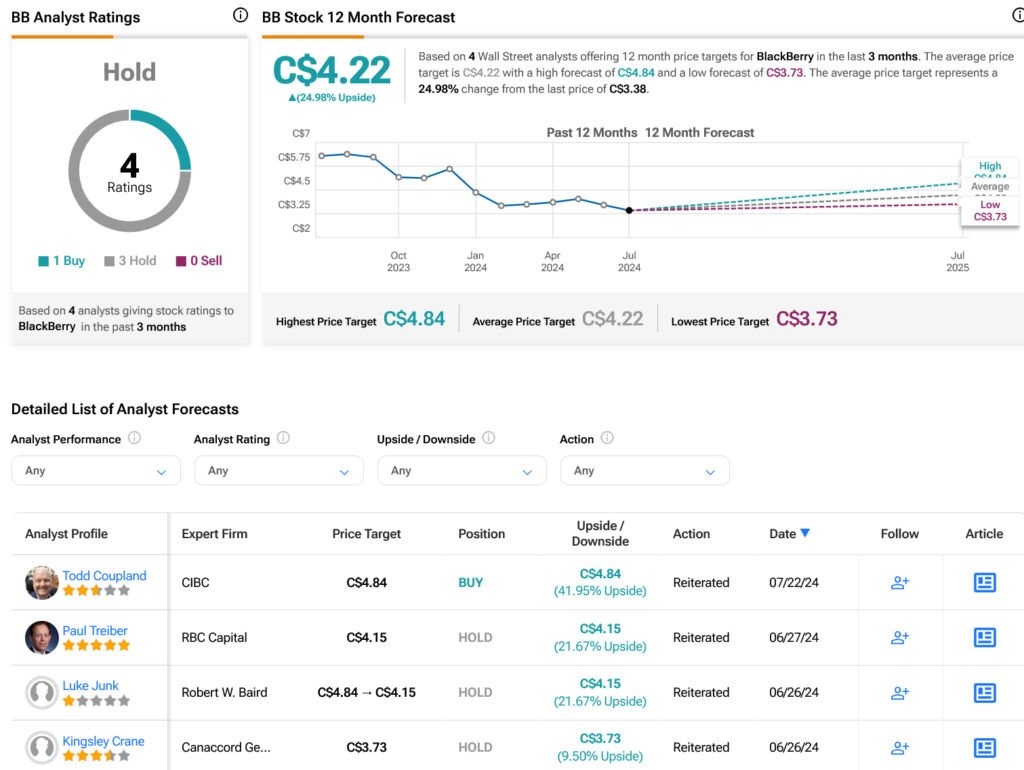

Turning to Wall Street, analysts have a Hold consensus rating on BB stock based on one Buy and three Holds assigned in the past three months, as indicated by the graphic below. After a 49.18% loss in its share price over the past year, the average BB price target of C$4.22 per share implies 24.98% upside potential.