Streaming giant Netflix (NFLX) faced a major setback in its gaming ambitions as it shut down its Southern California-based studio, Team Blue. Founded in 2022, the studio was working on a highly anticipated triple-A PC game but was unable to make significant progress, leading to its closure.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

This resulted in layoffs of about 30 employees, including experienced game developers with backgrounds in popular franchises like Microsoft’s (MSFT) Halo and Sony’s (SONY) God of War.

Following this move, NFLX is now shifting its focus towards developing and acquiring casual games, primarily designed for mobile devices. This aligns with the company’s broader strategy of keeping users engaged and attracting new subscribers beyond its core streaming content.

NFLX Strives to Grow on Third-Party Partnerships

While scaling back its internal game development, Netflix remains open to collaborating with third-party developers. In 2024, the company added three titles from Take-Two Interactive’s (TTWO) Grand Theft Auto series to its platform, reflecting its willingness to partner with established gaming companies.

Additionally, Netflix has been actively acquiring studios to support its gaming pipeline, like Night School, Boss Fight, Next Games, and Spry Fox.

Moreover, Netflix has been actively working on enhancing its gaming platform. The company is developing a new app, Netflix Game Controller, that can transform smartphones into controllers, enabling users to play games on their TVs or computers. This should boost the attractiveness of Netflix’s gaming offerings.

Is NFLX a Good Stock to Buy?

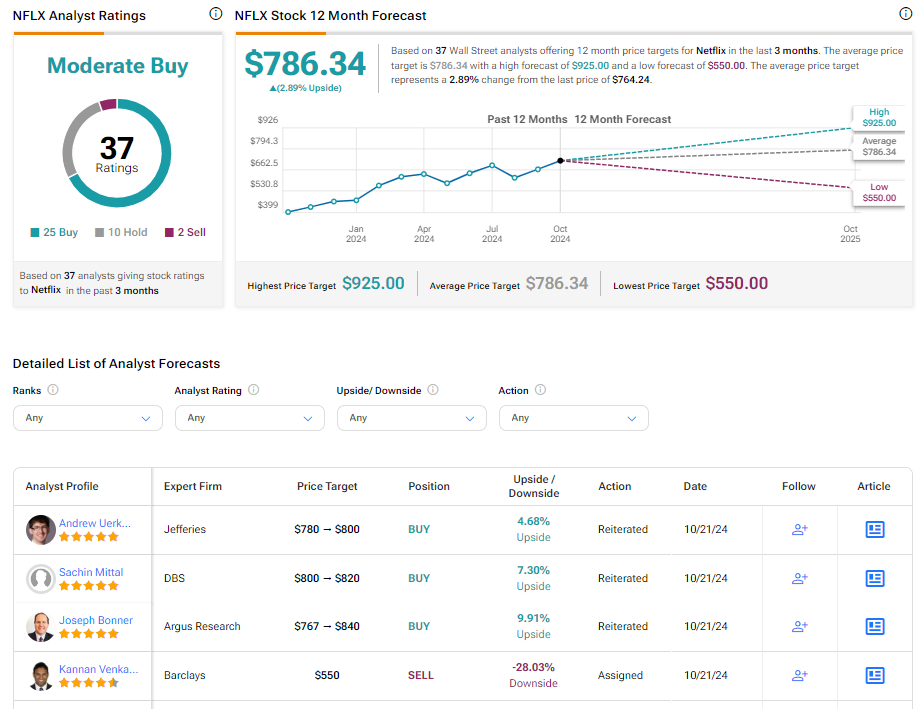

Turning to Wall Street, NFLX has a Moderate Buy consensus rating based on 25 Buys, 10 Holds, and two Sells assigned in the last three months. At $786.34, the average Netflix price target implies 2.89% upside potential. Shares of the company have gained about 57% year-to-date.