British bank HSBC (HSBC) has initiated coverage of streaming giant Netflix (NFLX) with a Buy rating, saying that the recent pullback in the shares presents an opportunity for investors.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

HSBC also placed a $107 price target on NFLX stock, which is 20% higher than where the shares currently trade. The bank said Netflix’s stock is down almost entirely due to its takeover pursuit of Warner Bros. Discovery (WBD) and that the current share price does not reflect strengthening earnings.

Mohammed Khallouf, a top five-star rated analyst with a 64% success rate, writes in a note to clients that Netflix also has a long runway for international growth and expansion. He cites deepening monetization, improving profitability, and a “sizable international opportunity” as reasons for his bullish outlook.

A Buying Opportunity In NFLX Stock

In his note, Khallouf directly addresses the elephant in the room, discussing Netflix’s $83 billion takeover bid for Warner Bros. Discovery. He believes the deal reflects mounting pressures in a maturing streaming market, noting that Netflix’s domestic market is nearly saturated and that competition is intensifying.

Khallouf goes on to write that the proposed takeover is compelling, arguing that a Netflix-Warner Bros. combination “would be a winner.” The analyst estimates that the merged group could lift Netflix’s 2028-29 earnings by 2% to 4%. Overall, HSBC says that Netflix’s “earnings outlook remains sturdy.”

Is NFLX Stock a Buy?

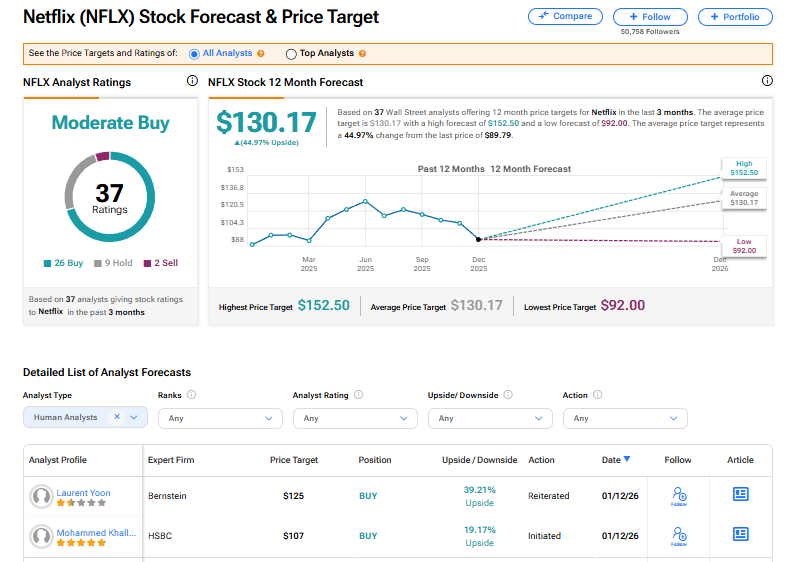

The stock of Netflix has a consensus Moderate Buy rating among 37 Wall Street analysts. That rating is based on 26 Buy, nine Hold, and two Sell recommendations issued in the last three months. The average NFLX price target of $130.17 implies 44.97% upside from current levels.