While Netflix stock (NASDAQ:NFLX) was a compelling buy in mid-2022, the stock has since more than tripled and now trades at 12.6x book, 7.8x sales, and 50x earnings. Meanwhile, the competitive threats that caused the 2022 sell-off haven’t gone away. Netflix’s revenue growth has slowed over the past two years, with a CAGR of just 6.6%. In the face of growing competition and a sky-high valuation, I’m bearish on NFLX. I think Netflix stock may return 0% over the next 10 years.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

This could occur even if the business performs relatively well. For example, if the company’s P/E multiple contracts to a more reasonable level, say 19x by 2034, it would completely offset compound annual EPS growth of 10%. In short, multiple contractions can sting. Now, let’s take a look at Netflix’s opportunities and threats.

Competition Is Everywhere

Netflix had a tremendous first-mover advantage in streaming, but lately, everyone has been rushing into the streaming space. First, you have all of the free streaming platforms like YouTube, The Roku Channel, Tubi, Pluto TV, and many others. Did I mention TikTok and Instagram Reels? These free services impair the pricing power of subscription services like Netflix, Disney+, Amazon Prime Video, Hulu, Max, Paramount+, Apple TV+, and Discovery, among others.

With so many options, it seems that the only thing keeping Netflix subscribers around is the enormous amount of money the company spends on content. This forced investment, or “additions to content assets,” averaged $15.7 billion over the past three years. I see this as Netflix’s primary competitive advantage, but it isn’t a good one. Adult viewers often watch content one time and then demand more. In this sense, Netflix’s content depreciates in value very, very quickly.

Are Insiders Selling Into the Buybacks?

In 2023, Netflix repurchased more than $6 billion of common stock. Buying back stock is a good idea when your shares are undervalued. However, in Netflix’s case, it appears that insiders haven’t been as bullish. For the most part, insiders have been cashing out on their stock options. Netflix insiders didn’t buy much at all over the past year.

The Financials

Netflix has averaged $5 billion in net income over the past three years. I think this accurately reflects the company’s true earnings power. In 2023, Netflix reported a higher free cash flow number, but it looks like the company was underspending on content additions (when compared to previous years).

Turning to the balance sheet, Netflix is in a good financial position, but not a great one. The company’s year-end current ratio was 1.1x, and the business had a long-term debt liability of $14.1 billion. Also, Netflix’s $258.6 billion market cap was about 12.6x its $20.6 billion book value. In other words, there is little value on Netflix’s balance sheet, especially compared to its enormous market cap.

Opportunities for Growth

Switching over to some of the positives for Netflix — the company has exposure to emerging markets, the ability to retain subscribers through ad-based subscriptions, and decent pricing power. Combine this with no dividend obligation and the capacity for share buybacks, and I think Netflix’s EPS could compound at a rate between 7% and 13% per annum over the next decade.

Netflix has a high penetration rate in North America, but it has been growing its members faster in the Europe, Middle East and Africa, Latin America, and Asia-Pacific regions. I see this as bullish for Netflix; these areas have lower GDP-per-capita than the United States and, thus, more room for organic growth.

Next, the company is still in the beginning stages of attracting advertisers to its platform. However, I see Netflix’s adoption of a low-priced membership, with ads, as a defensive move rather than a growth move. Remember, there are many free, ad-based streaming services to contend with.

Lastly, Netflix has shown the ability to raise prices. Sure, the company’s pricing power is likely to be capped by its plethora of competition. And, if Netflix’s prices are too high, consumers can easily switch to another platform. But, prices across the industry are relatively low, especially when you consider that we used to rent DVDs for $6 a piece in the 2000’s. So, I expect some modest price bumps, say 50% to 100% total over 10 years.

Is NFLX Stock a Buy, According to Analysts?

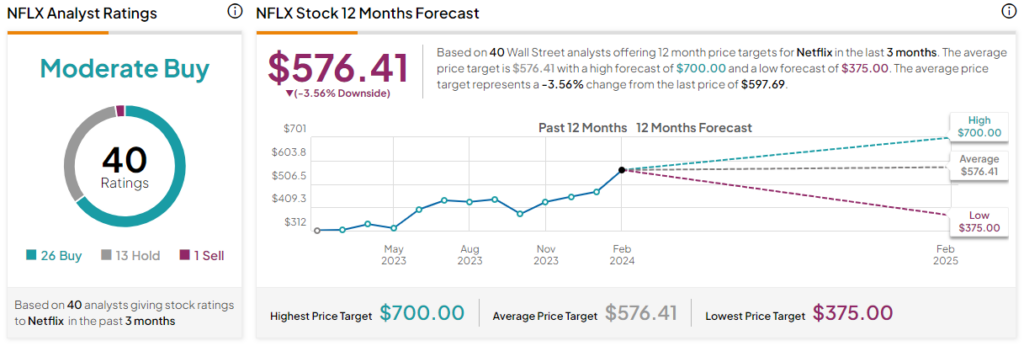

Currently, 26 out of 40 analysts covering NFLX give it a Buy rating, 13 rate it a Hold, and one analyst rates it a Sell, resulting in a Moderate Buy consensus rating. The average NFLX stock price target is $576.41, implying downside potential of 3.6%. Analyst price targets range from a low of $375 per share to a high of $700 per share.

The Bottom Line on NFLX Stock

Netflix operates in a very competitive industry and is forced to invest a ton of capital, not only to grow but to maintain its current position. Various free and low-priced streaming services give consumers far too many options, which impairs Netflix’s pricing power. I think growth is likely to slow substantially in the decade ahead, which will lead to a major P/E multiple contraction and a lost decade for shareholders.