Netflix stock may still be a Buy, even with the sky-high price tag. After all, the numbers speak for themselves. Shares of Netflix (NFLX) have exploded 23% since April 2. That leaves the S&P 500’s 3.9% gain in the dust. The stock closed at $1,150.99 on May 14.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Most stocks scrambled for cover as tariffs and market shocks battered Wall Street. Netflix stood tall. Investors rushed in. They saw Netflix as the rare safe haven, the one name built to keep thriving no matter what Washington hurled at it.

Netflix Sidesteps Tariff Drama And Keeps Winning

When Donald Trump’s tariff threats sent panic waves through markets in April, Netflix barely flinched. The streamer imports content, not goods. That shielded it from Washington’s firestorm. Even when Trump threatened 100% tariffs on foreign films, Netflix slipped just 2%.

Investors didn’t panic. They knew Netflix could shift production to the U.S. or raise prices to absorb any blow.

This defensive strength is nothing new. Netflix soared through the chaos of Covid lockdowns. Now it’s proving just as unstoppable through 2025’s storms.

Bulls Say Netflix Flywheel Still Powers Massive Upside

There’s only one real knock. Valuation. Netflix trades at 43 times forward earnings. That towers over the S&P 500 at 21 times and even the Magnificent Seven tech giants at 27 times.

Yet bulls argue Netflix earns the premium. Baillie Gifford strategist Ben James told Barron’s, “It’s built a flywheel that will be key to growing its margins.” His firm holds a $4.5 billion stake.

When they invested in 2015, Netflix margins were just 4.5%. Today they’ve soared to 27%. James still believes 50% margins are within reach by 2030.

More subscribers bring more content spending. More content pulls in more subscribers. The cycle feeds itself. The Netflix machine keeps turning.

Netflix Unlocks New Revenue And Drives Massive Expansion

Netflix isn’t standing still. Ad-supported tiers brought in only 4% of revenue in 2024. The company expects that to double this year. James says AI-driven ad targeting could unlock even bigger profits.

At the same time, Netflix is diving into live sports to grab new markets. CFO Spencer Neumann once pegged the total addressable market at up to 1 billion homes. So far, Netflix has captured only 301.6 million subscribers.

The brand is expanding offline too. Netflix Bites opened in Las Vegas in February. “Netflix Houses” experiential venues are set to launch next.

Analysts at FactSet expect Ebitda to surge 26% in 2025. They forecast another 20% gain in 2026 and 18% more in 2027.

Is NFLX a Good Stock to Buy?

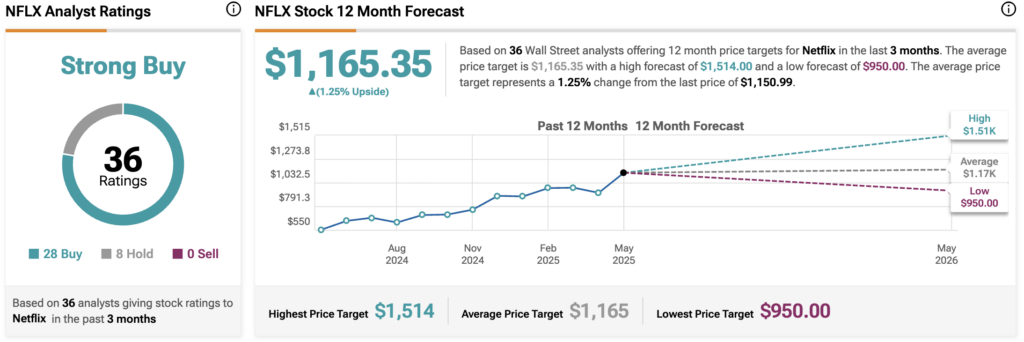

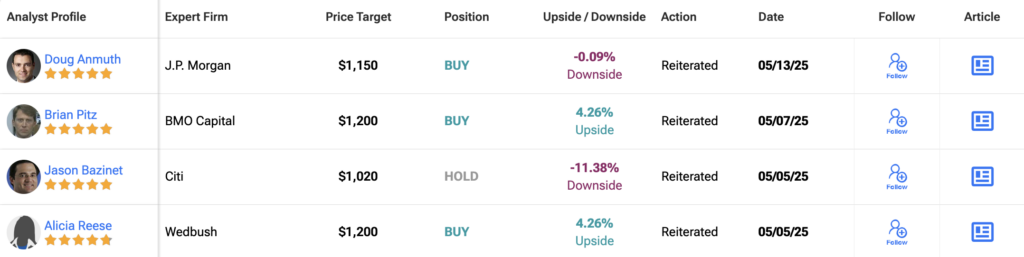

Wall Street says yes. Strong buy. According to TipRanks, Netflix holds a Strong Buy consensus rating based on 36 analyst reviews over the past three months. Out of those, 28 call it a buy. Eight rate it a hold. Not a single analyst has slapped a sell rating on the stock.

The average NFLX price target stands at $1,165.35, just a touch above where shares currently trade. The highest forecast sees the stock surging to $1,514.00. The lowest sits at $950.00. That range shows plenty of belief that Netflix has more gas in the tank.

Analysts are betting on continued subscriber growth, higher margins, and massive untapped markets.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue