In the fiercely competitive streaming industry, Netflix (NFLX) has crafted a winning strategy by balancing global growth with operational efficiency. This approach has allowed the company to maintain its leadership position amid a growing pool of competitors, all while delivering impressive financial results. Let’s dive into some key numbers from Main Street Data to see how these strategies drive strong performance and growth.

Netflix’s Global Subscriber Growth

Last week, Netflix reported a strong earnings beat, with revenue surging 13% in the first quarter of 2025. The company has seen a significant revenue boost, particularly from expanding into new international markets.

In Q1 2025, the Asia Pacific region led the charge with a remarkable 23% year-over-year revenue growth, generating $1.26 billion. This was closely followed by EMEA, which reported a 15% year-over-year increase, reaching $3.4 billion in revenue.

These impressive gains reflect Netflix’s successful strategy of tapping into diverse global markets. Central to this success is Netflix’s focus on content localization, tailoring its offerings to diverse regions, and ensuring a deeper connection with local audiences.

Netflix’s Cost Efficiency

At the same time, Netflix has made notable progress in cost-control initiatives. In Q1 2025, the company successfully reduced its operating expenses compared to the previous quarter. Most notably, marketing spending dropped to $688 million, down significantly from $976 million in Q4 2024. This disciplined approach to spending has contributed to improved margins and underscores Netflix’s focus on operational efficiency.

Overall, Netflix’s ability to tap into high-growth international markets while simultaneously tightening its cost structure forms the backbone of its winning formula. This dual approach not only supports stronger financial performance but also reinforces investor confidence in Netflix’s long-term vision. This includes the company’s ambitious goal to double its revenue by 2030 and achieve a $1 trillion market capitalization.

Is Netflix a Good Stock to Buy?

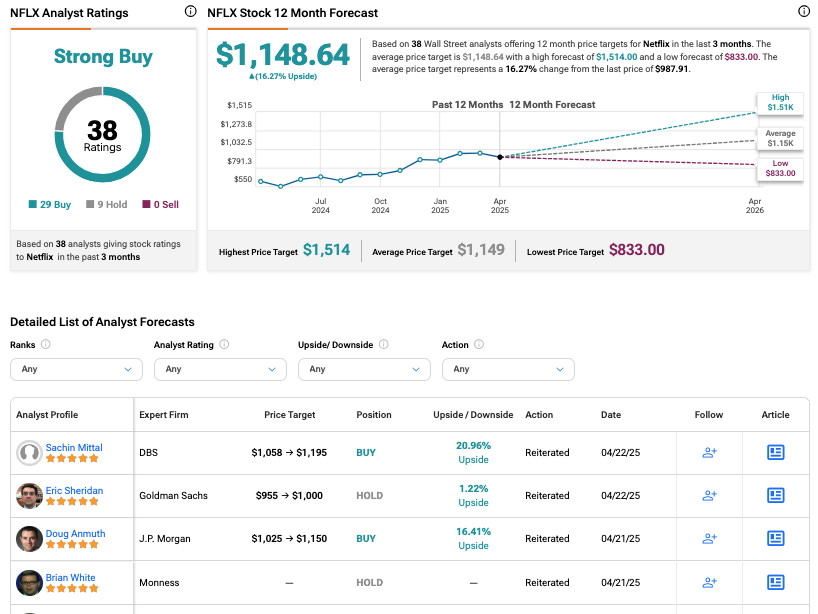

Impressed by the latest results, top analysts have raised their price targets with Buy ratings on NFLX stock.

Turning to Wall Street, NFLX stock carries a Moderate Buy consensus rating. Among the 38 analysts covering the stock, 29 have issued Buy recommendations, and nine rate it as Hold. Moreover, the Netflix price target of $1,148.64 implies a 16.3% upside potential from current levels.