A Top-rated analyst from Morgan Stanley (MS), Benjamin Swinburne, has named Netflix (NFLX) as his new Top pick in the Media & Entertainment sector, replacing Walt Disney (DIS). The analyst believes NFLX may deliver consistent growth amid a challenging global economic environment.

Further, the analyst has reiterated a Buy rating on NFLX stock, viewing the recent pullback in share price as a buying opportunity. Also, he set a price target of $1,150 (implying over 30% upside), with a bull case scenario pushing the target as high as $1,500.

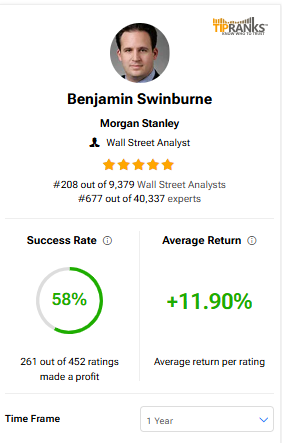

Before moving ahead, it is worth noting that Swinburne ranks 203 out of more than 9,300 analysts tracked by TipRanks. He has a success rate of 58% and has achieved an average return per rating of 11.9% in the past year.

NFLX’s Strong Growth, Dollar Tailwinds, and Engagement Drive Bullish Outlook

Swinburne highlighted that strong momentum in Netflix’s subscription business, along with recent U.S. dollar weakness, is likely to reduce risks to the company’s 2025 estimates, despite a softer advertising market.

While advertising growth is expected to double in 2025, the Top analyst says that ads will make up less than 5% of Netflix’s total revenues.

NFLX’s user engagement data further supports Swinburne’s bullish outlook. The company’s use of original content, licensed shows, and its global production capabilities helps enhance subscribers’ value.

Analyst Forecasts 20-25% EPS Growth

Looking ahead, the analyst projects NFLX’s adjusted earnings per share (EPS) will grow by 20–25% annually over the next four years, driven by double-digit revenue growth and margin expansion.

Also, he sees Netflix leading the global streaming market alongside Alphabet’s (GOOGL) YouTube, with both companies now exceeding $40 billion in annual revenue.

Is NFLX Stock a Good Buy?

Turning to Wall Street, NFLX stock has a Moderate Buy consensus rating based on 30 Buys, 10 Holds, and one Sell assigned in the last three months. At $1,109.31, the average Netflix stock price target implies a 27.45% upside potential.