Netflix (NFLX) stock had a disastrous 2022 that featured a 70% drop from peak to trough as the company’s growth narrative developed several cracks, including a decline of a million subscribers. However, Netflix managed to turn things around by reigniting subscriber growth and launching a strong advertising platform. Also, Netflix encouraged investors with an impressive Q3 2024 print. As a result, Netflix’s stock has more than quadrupled from its 2022 lows and is up over 60% year-to-date. Given this remarkable recovery, I’m bullish on the stock and believe the upward momentum is likely to continue.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Diving into NFLX’s Q3 Results

Netflix’s strong Q3 2024 earnings results are part of the reason I am bullish. The firm posted 15% year-over-year revenue growth as new series became big hits on the platform. A few fan favorites also returned to the streaming platform, boosting engagement among its users.

Also, profits grew at a faster pace than revenue, reaching $2.36 billion in the quarter. That’s a 41% year-over-year improvement. Netflix wrapped up the quarter with a 24.1% net profit margin. Rising revenue and profit margins should fortify the company’s P/E ratio. Netflix is currently valued at a 43 P/E ratio, which is much lower than the 85-90 P/E ratio the company held from 2019-2021.

However, it’s higher than the S&P 500’s 30 P/E ratio, but Netflix is growing at a faster pace than most of the index’s holdings. It’s hard to find a comparable company to gauge Netflix’s P/E ratio. The closest comparison is Disney (DIS), which has a 37 P/E ratio. However, Disney also has resorts, hotels, and other ventures, while Netflix’s entire business model revolves around streaming.

The “Less Is More” Mantra Should Boost the Stock Price

Netflix recently embraced a “Less Is More” mentality that has made me bullish on the stock. The studio is producing fewer films and is setting lower budgets for its movies and TV series. Netflix already has a vast content library, and keeping viewers engaged with some movies instead of too many of them should have a negligible impact on retention.

However, this shift should result in higher profit margins. Netflix is cutting back on the number of projects it takes on, focusing instead on making higher-quality content. While this means fewer movies, the idea is to produce better hits that not only attract viewers but also lead to stronger financial returns for long-term investors.

Netflix: Q4 2024 Content Slate Looks Promising

After announcing its Q3 2024 results, Netflix reminded investors of some of its upcoming projects that are set for Q4 2024. A second season for the popular Squid Game series, the Jake Paul/Mike Tyson fight, and two NFL games on Christmas Day were the top highlights. Netflix is still producing content that attracts new customers and gives existing subscribers more reasons to stick around.

The content slate is even better when revisiting the “Less Is More” mantra. Netflix can create content worth watching without overproducing new movies. Squid Game was a massive success upon its release, racking up 2.2 billion hours of watch time in the first 91 days of its release. That watch time is the equivalent of 265.2 million viewers completing the entire series. The continuation of this popular series isn’t enough to warrant the rally, but it’s one piece of Netflix’s puzzle. It gives many Netflix subscribers an additional reason to stay subscribed. By the time they complete the second season of Squid Game, another new flick or series may grab their attention.

The Ad Network Is Expanding

Netflix’s entrance into the online advertising industry has been successful, and it’s another reason why I am bullish on the stock. The streaming giant reported a 35% quarter-on-quarter increase in ad memberships during its Q3 earnings announcement. These memberships are more affordable than Netflix’s other plans, but they also generate sizable returns for the company.

The ad platform is still in its early stages, with Netflix yet to roll it out in some key markets, including Canada. Canadian subscribers can opt for ad memberships starting in the fourth quarter, and a broader rollout is expected in 2025. Subscriber growth rates have accelerated due to the new membership plan and other factors, increasing by 14.4% year-over-year. Advertisements should boost the company’s profitability and retain subscribers who need a more affordable plan.

Is Netflix Stock a Buy?

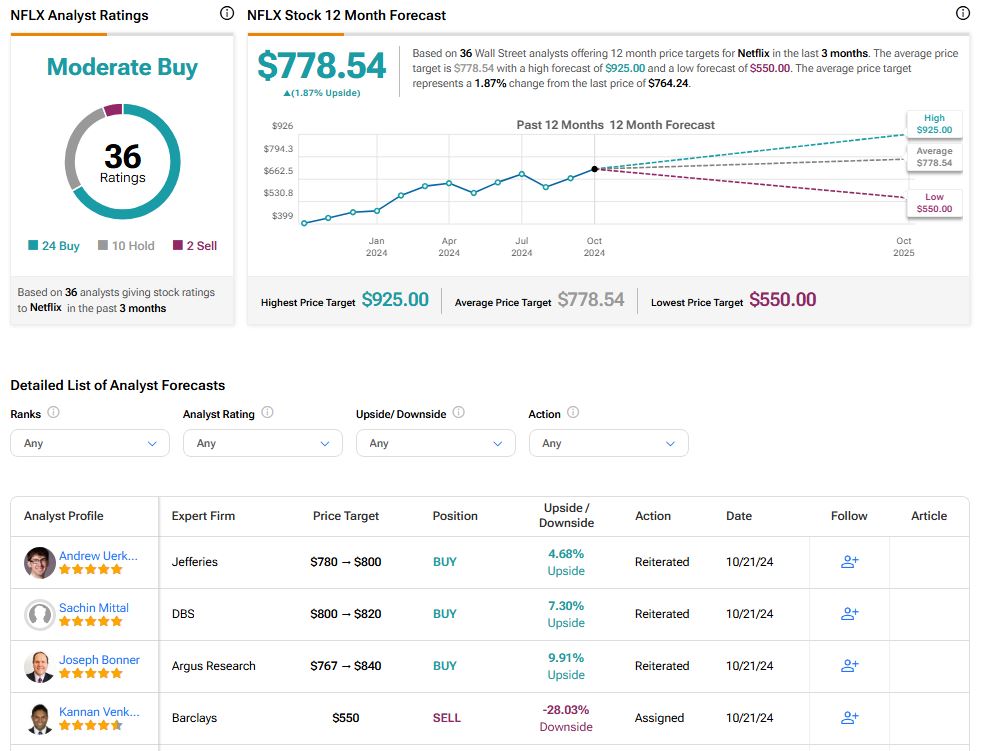

Netflix is currently rated as a Moderate Buy among 36 analysts. It has 24 Buy ratings, 10 Hold ratings and two Sell ratings. At $778.54, the average NFLX price target implies 1.87% upside potential.

The Bottom Line on Netflix Stock

Netflix stock has rebounded after a disappointing 2022. Growth has reaccelerated as the company’s slate of new movie releases and its new advertising plan have spurred growth. By adopting a “Less Is More” approach, Netflix aims to boost profit margins while focusing on producing higher-quality content. This shift could not only enhance the viewing experience for subscribers but also drive long-term profitability, positioning the company for sustained success.