NetApp (NASDAQ:NTAP) stock gained 7% in yesterday’s extended trade following the better-than-expected results for the fourth quarter of Fiscal Year 2023. However, the data management software provider gave a conservative outlook due to a slowdown in cloud demand.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenue decreased 6% year-over-year to $1.58 billion but surpassed the analysts’ consensus estimate of $1.54 billion. Meanwhile, adjusted EPS increased 8.5% to $1.54, handily beating analysts’ expectations of $1.35.

Billings in the reported quarter were down 17% year-over-year to $1.67 billion. NTAP highlighted macro uncertainty as the primary cause of the decline in billings and year-over-year revenues.

Outlook

Looking forward, NetApp expects to report fiscal first-quarter revenue in the range of $1.325 billion to $1.475 billion, compared with $1.59 reported in Q1 FY22. Further, adjusted earnings are expected to be between $1 and $1.1 per share. The analyst estimates are pegged at $1.47 billion in revenues with an EPS of $1.20.

For Fiscal Year 2024, the company anticipates net revenues to decline by low-to-mid single digits on a year-over-year basis due to the challenging macro conditions, which could continue to pressure IT budgets. Additionally, adjusted EPS is forecasted to lie between $5.65 and $5.85.

What is the Price Target for NTAP Stock?

The company remains committed to retaining users by constantly launching new features in its ONTAP software. Moreover, its efforts to reward shareholders are encouraging. Nevertheless, the uncertain economy will prohibit firms from investing extensively in technology, which would harm NTAP’s top-line growth.

Overall, NTAP stock has a Hold consensus rating based on two Buys and two Sells. The average price target of $65.75 implies nearly 1% downside potential from the current level. The stock has gained 10.9% so far in 2023.

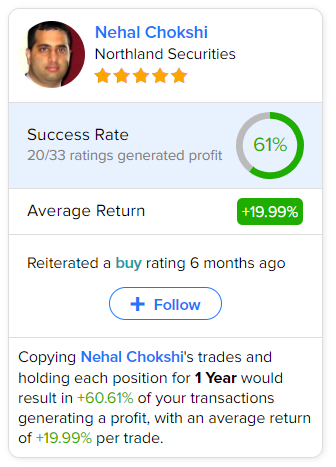

As per TipRanks data, the most accurate and profitable analyst for NetApp is Northland Securities analyst Nehal Chokshi. Copying the analyst’s trades on this stock and holding each position for one year could result in 61% of your transactions generating a profit, with an average return of 19.99% per trade.