NetApp (NASDAQ:NTAP) shares are up nearly 12% in the early session today after the data infrastructure company announced its second-quarter results. Despite a 6% year-over-year decline, revenue of $1.56 billion came in better than expectations by $30 million. In sync, EPS of $1.58 outpaced estimates by $0.19.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, Hybrid Cloud segment revenue declined by $110 million to $1.41 billion. Revenue from the Public cloud segment, on the other hand, ticked higher by $12 million to $154 million. While billings declined by 9% to $1.45 billion, public cloud annualized revenue run rate (ARR) increased by 1% to $609 million.

Further, all-flash array ARR increased by 1% to $3.1 billion. Looking ahead to Fiscal year 2024, NetApp expects net revenue to decrease by 2% over the prior year. EPS for the year is anticipated to be between $6.05 and $6.25. For the upcoming quarter, the company expects EPS to hover between $1.64 and $1.74. Revenue for the quarter is seen hovering between $1.51 billion and $1.67 billion.

In addition, NetApp has declared a cash dividend of $0.50 per share. The NTAP dividend is payable on January 24, 2024, to investors of record on January 5, 2024.

What Is the Target Price for NTAP Stock?

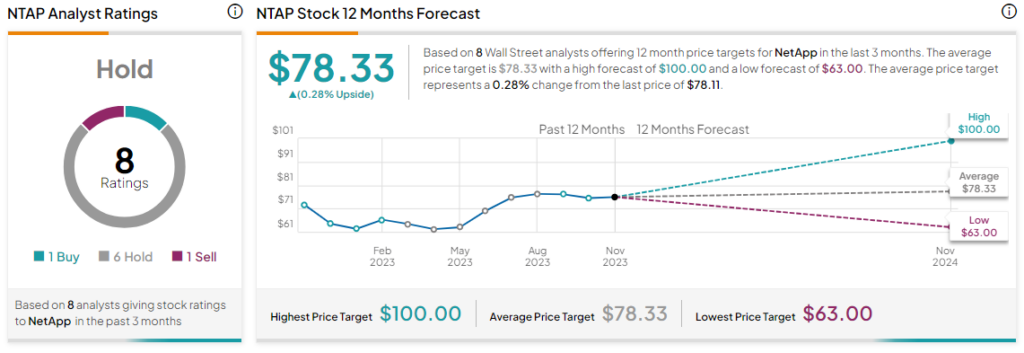

Today’s price surge comes on top of a 9% rise in NetApp shares over the past month. Overall, the Street has a Hold consensus rating on NetApp, and the average NTAP price target of $78.33 implies the stock may be fairly priced at current levels.

Read full Disclosure