Food and beverage company Nestle (NSRGY) announced on October 30 that it has acquired Freshly, a fresh-prepared meal delivery service, in a deal worth $950 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

As per the terms of the agreement, there are possible earnouts of up to $550 million, contingent upon Freshly achieving specific growth targets.

In addition to helping Nestle compete with other meal kit subscriptions, the acquisition will give it access to Freshly’s highly specialized consumer analytics platform and distribution network. The food delivery service is expected to generate $430 million in sales in 2020.

Nestlé USA Chairman and CEO, Steve Presley, commented, “Consumers are embracing ecommerce and eating at home like never before. It’s an evolution brought on by the pandemic but taking hold for the long term. Freshly is an innovative, fast-growing, food-tech startup, and adding them to the portfolio accelerates our ability to capitalize on the new realities in the U.S. food market and further positions Nestlé to win in the future.”

Nestle originally snapped up a 16% stake in Freshly in 2017 to evaluate and test this developing market.

Founded in 2015, Freshly is a weekly subscription food delivery service developed by chefs and nutritionists, with the company offering fresh meals that can be heated and served in only three minutes. Since then, it has grown substantially, with it now shipping more than one million meals per week to customers in 48 states.

According to a letter written by Freshly founder and CEO Michael Wystrach, the company will continue to operate as a standalone business.

“We will continue to maintain our own strict standards and maintain complete control of our products… Our meals will not be changing, and there are no plans to change ingredients or integrate Nestlé products into Freshly meals, but we are excited about potential opportunities for the future,” Wystrach noted.

In response to the news, shares of competing food delivery service Blue Apron plummeted 12%.

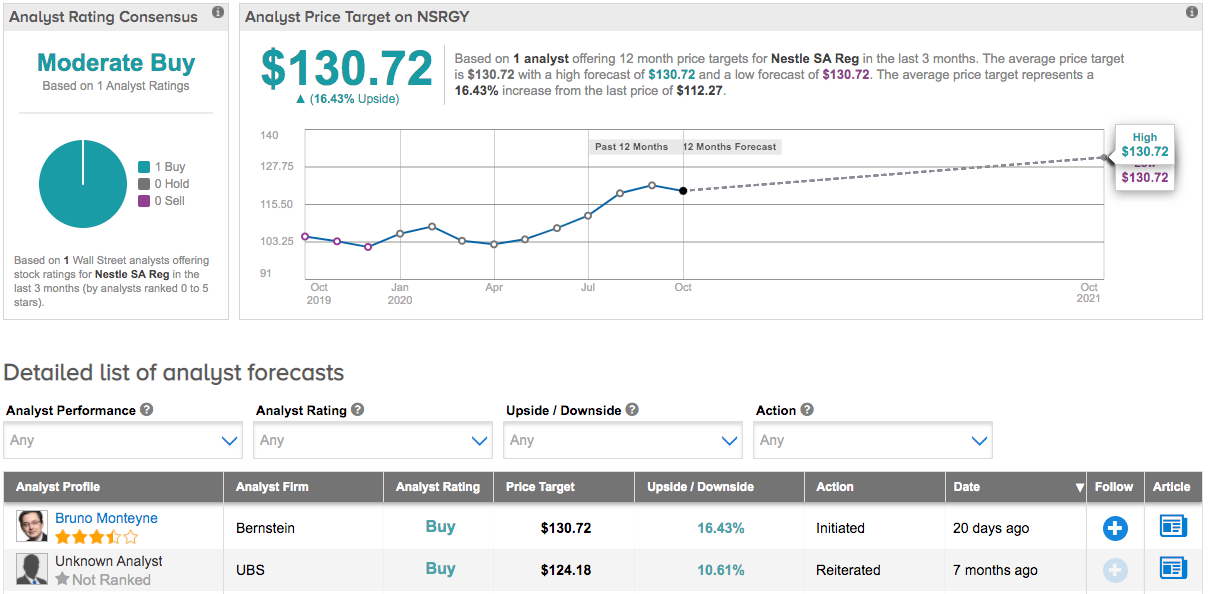

For Bernstein analyst Bruno Monteyne, who initiated coverage with a Buy rating and $130.72 price target (16% upside potential) a few weeks prior to the announcement, Nestle’s “bold innovation” and “effective portfolio management” should allow it to remain relevant to consumers.

As of right now, Monteyne is the only analyst that has published a review recently. To this end, Nestle has a Moderate Buy analyst consensus, and the average analyst price target matches Monteyne’s. (See Nestle stock analysis on TipRanks)

Related News:

Dunkin’ To Be Taken Private By Inspire Brands In $8.8B Deal

Colgate’s 3Q Profit Outperforms Driven By Higher Prices

Starbucks Tops 4Q Estimates, Sees Strong Global Comps In FY21