Switzerland-based food and beverage company Nestlé SA (DE:NESM) has cut down its full-year forecast amid faltering demand and rising costs. For 2024, the company has lowered its sales growth guidance to 2%, down from an earlier target of at least 3%. Additionally, it expects an underlying trading operating profit (UTOP) margin of approximately 17%, a slight decrease from the 17.3% reported in 2023.

Nestlé S.A. is a multinational conglomerate known for brands such as Nescafé, Maggi, Milo, and KitKat.

Nestlé Misses Sales Estimates

In the third quarter, Nestlé reported a 1.9% increase in its organic sales growth, excluding currency fluctuations and M&A effects. With this, it missed analysts’ expectations of a 3.1% increase. The company attributed the sales shortfall partially to decreased retailer inventories, indicating that overstocking in the first half had previously boosted results.

Within its product categories, coffee was the biggest growth contributor in the first nine months and achieved mid-single-digit gains, driven by the three top coffee brands: Nescafé, Starbucks, and Nespresso. On the other hand, Pet Care and Frozen Food businesses struggled due to higher competition.

Regionally, organic sales growth in Nestlé’s largest market, North America, was weakest, with a decline of 0.3% in nine months. Meanwhile, Europe registered a growth of 3.3% and Asia, Oceania, and Africa region was up by 3.6%.

Moving ahead, Nestlé would introduce more discounts and reduce prices to attract shoppers. In the last few years, the company has raised its prices in response to rising costs.

Jefferies Weighs in on Nestlé’s Latest Results

Following the results, analysts at Jefferies noted that the latest numbers were significantly below even the adjusted expectations. They further cautioned that this disappointing performance could lead to consensus earnings cuts of 3-4% for the full year.

Moreover, Jefferies observed that the company’s slowing growth raises wider concerns for the food and consumer goods sector.

Is Nestlé Share a Good Buy?

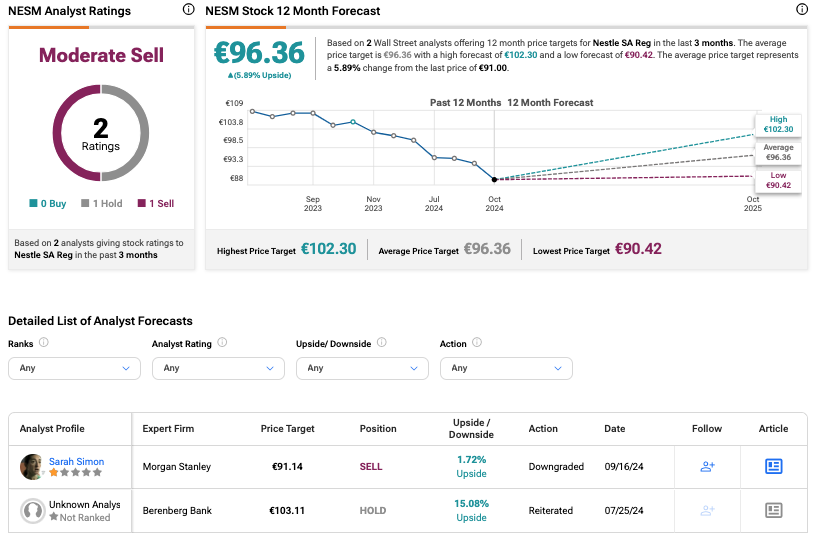

According to TipRanks, Nestle shares in the German market have received a Moderate Sell rating based on one Hold and one Sell recommendation. The Nestlé share price forecast is €96.36, which is 6% higher than the current trading levels.

Year-to-date, NESM stock has gained 14%.