NextEra Energy (NEE) reported mixed results in the third quarter. The energy company reported adjusted earnings of $1.03 per unit, compared to $0.94 per unit in the same period last year. This was above analysts’ expectations of earnings of $0.98 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Furthermore, the company’s revenues increased by 5.6% year-over-year to $7.6 billion but fell short of consensus estimates of $8.1 billion.

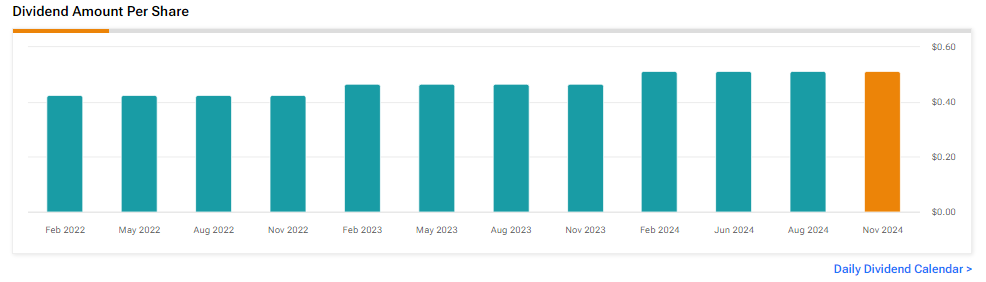

NEE Announced Quarterly Dividend

Additionally, NEE announced a quarterly dividend of $0.515 per share. The dividend is payable on December 16 to shareholders of record on November 22, 2024.

NEE Reiterates FY24 Outlook

Looking ahead, the company reiterated its FY24 outlook and now expects adjusted earnings per share to be in the range of $3.23 to $3.43. In addition, over the long term, for 2025, 2026, and 2027, the company has forecasted adjusted earnings per share to be in the ranges of $3.45 to $3.70, $3.63 to $4.00, and $3.85 to $4.32, respectively. Furthermore, NEE continues to expect to grow its dividends per share at around 10% every year through at least 2026.

Is NEE a Good Buy Right Now?

Analysts remain cautiously optimistic about NEE stock, with a Moderate Buy consensus rating based on five Buys, four Holds, and one Sell. Over the past year, NEE has increased by more than 65%, and the average NEE price target of $88.22 implies an upside potential of 5.4% from current levels. These analyst ratings are likely to change following NEE’s results today.