Shares of National Express owner Mobico Group (GB:MCG) jumped over 15%, as of writing, after the transportation company reported higher profits for the first half of 2024. The company’s adjusted operating profit increased 28.1% year-over-year on constant currency to £71.2 million. Meanwhile, its revenue grew 7.6% year-over-year on a constant exchange rate to £1.65 billion in H1 2024.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Mobico Group is a British transportation provider that offers bus, train, and coach services.

Mobico Delivers Strong H1 Numbers

In H1 2024, Mobico witnessed favorable passenger demand across most of its operations. Among its regions, revenue from North America grew 6.4% at constant currency, while UK revenue increased 7.7%.

The company’s Spanish subsidiary, ALSA, achieved record performance, with growth across its operations, notably in Regional and Long Haul services. ALSA’s adjusted operating profit surged 43.2%, fueled by a 10.3% increase in revenue. On the other hand, German revenue fell 12.5% due to lower subsidies.

For the full year, Mobico maintained its operating profit guidance in the range of £185 million to £205 million. Additionally, Mobico’s Accelerate cost-saving program is expected to generate savings of £30 million from Accelerate 1.0 and £10 million from Accelerate 2.0 in FY24.

Mobico’s Turnaround Efforts Remain on Track

After facing challenges in the past one and a half years, Mobico is now on track in terms of its restructuring efforts.

The company’s initiatives include selling its North American school bus business, which has negatively impacted profitability due to staff shortages and inflationary pressures. Mobico has started the formal sale process for this business.

What Is the Target Price for Mobico?

Year-to-date, MCG stock has lost over 20% of its value.

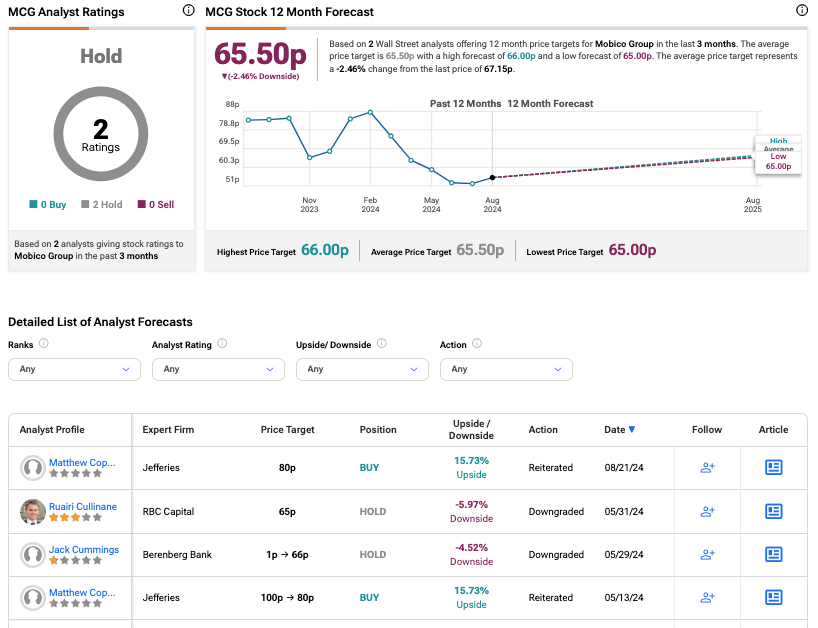

According to TipRanks’ analyst consensus, MCG stock has received a Hold rating based on two Hold recommendations. The Mobico share price forecast is 65.50p, which is 2.5% below the current price level.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue