Billionaire investor and Trump advisor Elon Musk has urged President Trump to relax reciprocal tariffs and allow free trade between nations. The news was first reported by the Washington Post, citing people familiar with the matter. Meanwhile, Musk’s net worth dropped below $300 billion for the first time since November 2024, as the value of his Tesla (TSLA) holdings plummeted, following a 10.4% fall on April 4 and a further 2.6% decline on Monday.

The report suggests that Musk personally appealed Trump to reverse the sweeping tariffs, given he is a big advocate of free trade, but his attempts were futile, as the President appears unwilling to change his decision

Musk and Navarro Take Digs at Each Other

Notably, Musk has become increasingly vocal of his disagreement with the administration’s tariffs. Musk called for zero-tariffs between the U.S. and Europe during a video conference with Italy’s Deputy Prime Minister Matteo Salvini over the weekend. Musk also criticized White House trade advisor and the architect of the tariffs, Peter Navarro, in an X post on Sunday, saying that being Harvard trained is a “bad thing, not a good thing.” Navarro, in turn, openly attacked Musk, calling him a “car assembler” who wants to procure cheap foreign parts to keep his manufacturing costs down.

This is not the first time that Musk has disagreed with Trump on tariff decisions. During Trump’s first term as President, Musk openly challenged the administration, and Tesla even sought to file a lawsuit to overturn the tax on Telsa imports from China. Trump has also expressed differing opinions about Trump’s policies on the H-1B visa and DOGE’s (Department of Government Efficiency) efforts to reduce wasteful government spending.

Will Tesla Go Up in the Future?

On Monday, Musk lost $4.4 billion from his net worth due to continued losses on Tesla’s stock price. His fortune fell to $297.8 billion on April 7, according to the Bloomberg Billionaires Index. Year-to-date, Musk’s net worth has slipped by $134.7 billion, as concerns over the potential impact of 54% tariffs on Chinese imports continue to haunt the electric vehicle (EV) maker.

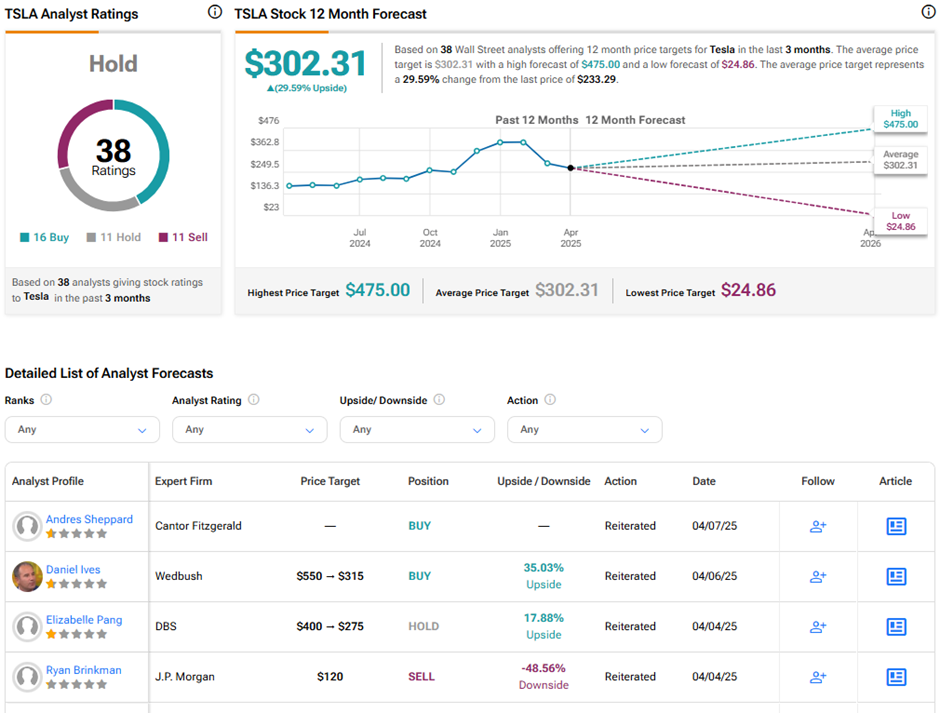

Tesla’s stock has taken a steep setback ever since Musk assumed the role of DOGE’s head. Additionally, his political choices and closeness to Trump amplified the backlash toward his EV company. The automaker’s sales have collapsed owing to the severe consumer backlash and brand deterioration. Even Tesla’s long-time bull, analyst Daniel Ives of Wedbush, slashed the price target on TSLA stock by 43%, lowering it to $315, citing a “perfect storm” of tariffs and brand crisis.

For now, Wall Street remains cautious about Tesla’s stock trajectory. On TipRanks, TSLA stock has a Hold consensus rating based on 16 Buys, 11 Holds, and 11 Sell ratings. The average Tesla price target of $302.31 implies 29.6% upside potential from current levels.