In this piece, I evaluate two data analytics stocks: MicroStrategy (MSTR) and Palantir Technologies (PLTR). A closer look leads me to adopt a neutral view of both stocks, but Palantir looks like the better investment.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

MicroStrategy considers itself “the world’s first Bitcoin development company.” However, it also provides enterprise analytics and mobility software, in addition to designing, developing, marketing, and selling its software platform via licensing arrangements and cloud-based subscriptions. Meanwhile, Palantir Technologies develops software products for human-driven analysis of real-world data, aiming to create the world’s best user experience for data analysis.

Shares of MicroStrategy have surged 25% over the last three months, bringing their year-to-date gain to 158% and their one-year return to an impressive 423%. Meanwhile, Palantir stock has soared 41% over the last three months, more than doubling year-to-date, and is up 145% over the last year.

Both companies’ three-month share-price surges likely have little to do with each other, given that MicroStrategy is widely seen as a backdoor Bitcoin ($BTC-USD) play. The MSTR share price is relatively correlated to the price of Bitcoin. However, there’s much more to the story with each of these stocks.

A Closer Look at MicroStrategy (MSTR)

Although MicroStrategy is a data analytics stock, the company’s connection to Bitcoin can’t be ignored. For a company with a market capitalization of more than $33 billion, it may be surprising to realize that MicroStrategy reports less than $500 million in operating revenues annually. Instead, a large Bitcoin holding accounts for most of the company’s valuation. With Bitcoin up a mere 5% over the last three months versus MicroStrategy stock’s 25% gain, a neutral view seems appropriate.

MicroStrategy could soon own more Bitcoin than Grayscale, which has unloaded a lot of tokens since the spot ETFs were introduced in the U.S. earlier this year. According to its latest regulatory filing on September 20, Grayscale held more than 620,000 Bitcoins in its Bitcoin Trust before the launch of the spot ETFs in January. The firm now holds a little over 254,000 tokens between its Bitcoin Trust and Bitcoin Mini Trust.

Meanwhile, MicroStrategy recently raised capital and is now flush with over $1 billion that it can put to work. Presumably, it will purchase thousands of additional Bitcoins. However, some investors may question whether this is a good time to be buying more Bitcoin when it trades for more than $60,000.

Meanwhile, MicroStrategy paid an average price of $65,882 for the 12,222 Bitcoins it bought between the end of the first quarter and August 1, the date of its latest earnings release. It’s somewhat akin to a company repurchasing its own stock while the price is high rather than during times when the price is depressed.

Microstrategy’s Data Analytics Operations

While I’m neutral on the company as a whole, a look at MicroStrategy’s data analytics business does reveal some promising trends. In fact, the business posted a 45% year-over-year increase in non-GAAP (generally accepted accounting principles) subscription billings during the second quarter, reflecting strong growth.

MicroStrategy’s flagship platform is MicroStrategy 10, which consists of MicroStrategy Analytics, MicroStrategy Mobile, and User. The company recently announced the release of MicroStrategy One, a fully cloud-native AI/ BI platform that integrates with Microsoft Teams. MicroStrategy One also offers new features for the company’s AI bot, Auto, which can now answer open-ended questions.

However, the operating business seems like a mere footnote to MicroStrategy’s corporate direction and outlook. It makes little sense for investors to see MSTR as anything but a Bitcoin play. With the Bitcoin price where it is, and potential plans to buy more at a high price, I can’t adopt a bullish view of the stock.

How Does Wall Street Rate MSTR Stock?

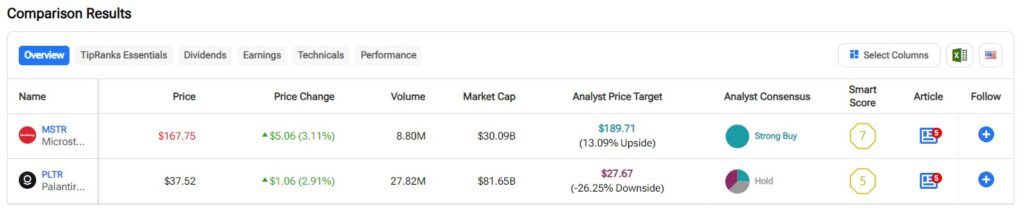

Wall Street offers MicroStrategy a Strong Buy consensus rating based on seven Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $189.71, the average MicroStrategy stock price target implies upside potential of nearly 18%.

A Closer Look at Palantir Technologies (PLTR)

Meanwhile, Palantir Technologies has been somewhat of a Wall Street darling since its initial public offering in 2020. Sales and margins are both heading in the right direction. However, after the recent run-up in the stock price, a neutral view looks appropriate.

Palantir Technologies states that it “builds software that empowers organizations to effectively integrate their data, decisions, and operations.” The company’s products include the AIP platform, which brings artificial intelligence into operations, and the foundry platform, which Palantir touts as the “operating system for the modern enterprise.” Palantir also offers the Gotham platform for global decision making and the Apollo platform for continuous delivery.

Palantir’s Financials

While Palantir just became profitable in 2022, its price-to-earnings (P/E) ratio remains elevated. However, that’s not the biggest concern right now because that multiple should continue to come down in time with scalability.

I’m more concerned about the price-to-sales (P/S) ratio of 32.9x, vis-a-vis the software industry’s current and three-year average P/S of ~10x. On the other hand, I believe that Palantir does deserve a premium for its AI capabilities, given that AI stocks have been hot all year long. However, the size of that premium is up for debate. Palantir is priced as a growth stock, but it’s not putting up the revenue growth to necessarily warrant that growth multiple. The company’s top line rose a mere 16.7% in 2023. However, I do like the fact that the company’s margins are heading in the right direction.

Palantir’s operating margins and net income margins have been increasing over the past year. As scalability kicks in, Palantir will reap the benefits of an 83% year-over-year increase in paying customers. As such, it’s clear that Palantir won’t be going anywhere anytime soon. However, I would prefer to wait for a more attractive entry price before becoming more constructive on the shares.

How Does Wall Street Rate PLTR Stock?

Palantir Technologies has a Hold consensus rating based on four Buys, six Holds, and six Sell ratings assigned over the last three months. At $27.67, the average PLTR stock price target is more than 28% lower than the recent market price.

Conclusion: Neutral on MSTR and PLTR

Although both MicroStrategy and Palantir Technologies receive neutral ratings, I prefer Palantir from this pairing. This doesn’t seem like a wise time to be purchasing more Bitcoin. As a result, I believe it would make more sense for MicroStrategy to watch and wait for a significant drawdown in the Bitcoin price. Given the cryptocurrency’s volatility, it seems like only a matter of time before an attractive buying point will appear.

On the other hand, Palantir Technologies looks like an excellent company to invest in, but its valuation level and recent run-up are reasons for caution. Palantir hasn’t been this expensive on a per-share basis since about January and February 2021. Thus, I’d like to watch and wait for a buy-the-dip opportunity in Palantir shares.