Microstrategy (NASDAQ:MSTR) announced on Monday that it had paid off a $205M loan two years earlier than planned, with 34,619 bitcoins (BTC-USD) held as collateral released. The loan had been scheduled to mature on March 23, 2025, but MSTR voluntarily repaid it and all other obligations under their credit agreement with Silvergate Capital (NYSE:SI) for approximately $161.0M. This was made possible by MSTR raising over $300M from the sale of its shares, some of which was used to pay off the loan.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

MSTR also revealed that it had acquired 6,455 bitcoins for approximately $150M in cash between February 16, 2023, and March 23, 2023, at an average price of $23,238 per bitcoin. As of March 23, 2023, the company holds a total of 138,955 bitcoins, acquired at an aggregate purchase price of approximately $4.14B.

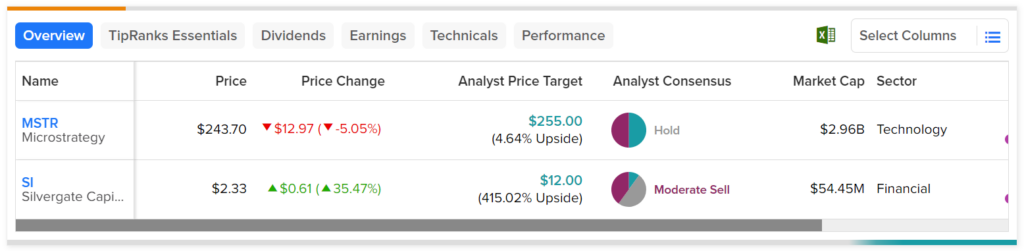

Turning to Wall Street, analysts are currently cautious on both stocks, with MSTR and SI rated as Hold and Moderate Sell, respectively. As a result of today’s news, MSTR fell over 5% while SI soared over 35%.