Shares of Microstrategy (MSTR) plunged in after-hours trading after the analytics software company, better known for its massive Bitcoin Holdings (BTC-USD), reported earnings for its third quarter of Fiscal Year 2024 and announced its goal of raising $42 billion of capital over the next 3 years. Earnings per share came in at -$1.56, which missed analysts’ consensus estimate of -$0.12 per share.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Sales decreased by 10.4% year-over-year, with revenue hitting $116 million. This also missed analysts’ expectations of $121.45 million. However, investors are likely more interested in the company’s Bitcoin.

As of April 26, Microstrategy held 252,220 Bitcoin at an average cost of $39,266 per Bitcoin. This equates to a total value of $16.007 billion. In addition, the firm’s BTC yield came in at 17.8% on a year-to-date basis. BTC Yield measures the percent change in the ratio of Bitcoin holdings to total assumed diluted shares. This metric helps the company evaluate whether its Bitcoin buying strategy adds value to shareholders (the higher the yield, the better).

MSTR’s Future Plans

Looking ahead to the future, MSTR plans to raise a total of $42 billion over the next three years in order to buy more Bitcoin. Referred to as its “21/21 Plan,” $21 billion will come in the form of at-the-money equity raises, while the remaining $21 billion will come from debt. This is a huge amount of capital, especially for a company with an enterprise value of $47 billion.

In addition, the company is targeting an annual BTC yield of 6% to 10% from 2025-27 as it looks to hopefully raise and deploy $42 billion into Bitcoin.

Is MSTR a Good Stock to Buy?

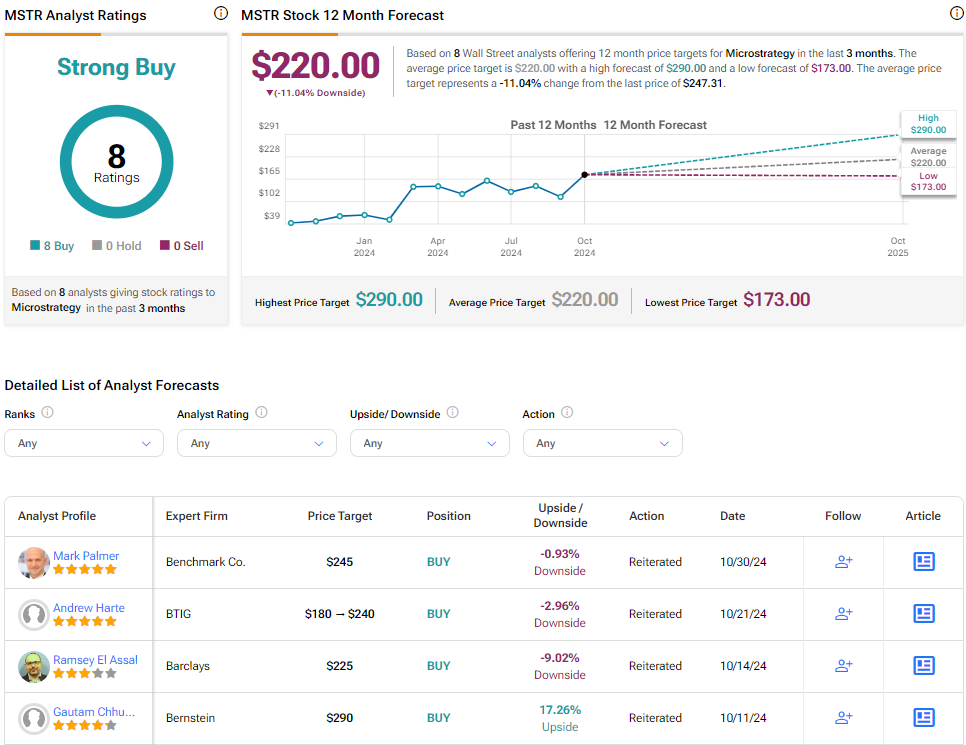

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on eight Buys assigned in the past three months, as indicated by the graphic below. After a 484% rally in its share price over the past year, the average MSTR price target of $220 per share implies 11% downside risk. However, it’s worth noting that estimates will likely change following today’s earnings report.