Five of the “Magnificent 7” stocks — Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META), Apple (AAPL), and Amazon (AMZN) — are set to report their quarterly results this week, making it one of the busiest weeks of the earnings season. Among them, Microsoft and Alphabet are in focus as both companies continue to expand their AI and cloud businesses. Using the TipRanks Stock Comparison Tool, we examine which of these two AI leaders Wall Street views as the stronger buy ahead of their Q3 results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Microsoft (NASDAQ:MSFT) Stock

Microsoft stock has risen about 25% year-to-date, as investors are upbeat about the company’s growth outlook and AI-driven expansion in its Azure cloud business. Recently, Microsoft announced a $30 billion investment in AI infrastructure in the U.K. by 2028, including $15 billion in capital spending and another $15 billion to expand its local operations. These large investments show Microsoft’s push to meet the strong global demand for AI infrastructure.

Looking ahead, Microsoft will report its Q1 FY26 earnings on Wednesday, October 29. Analysts expect earnings of $3.67 per share, up 11.2% from a year ago, and revenue of about $75.37 billion, reflecting a 15% year-over-year increase.

Ahead of its Q1 FY26 earnings, Wedbush analyst Daniel Ives maintained an Outperform rating on MSFT with a $625 price target, implying about 19% upside over the next 12 months. Ives sees FY26 as Microsoft’s “inflection year for AI growth,” driven by rapid Copilot adoption, which he estimates could add $25 billion in new revenue. He expects continued strength in Azure, fueled by growing AI workloads and cloud demand. According to Ives, Wall Street is still underestimating Microsoft’s AI-led upside.

Alphabet (NASDAQ:GOOGL) Stock

Alphabet stock has gained about 38% so far this year, helped by steady growth in its cloud and advertising units and growing confidence in its AI plans. The company is expanding its Gemini AI model across Google Cloud, Search, and Workspace to boost sales from both business and consumer users. With ad spending improving and cloud demand rising, investors are watching to see if these AI efforts can lift profits and earnings in the coming quarters.

Looking ahead, Alphabet is scheduled to report its Q3 2025 earnings on Wednesday, October 29. Wall Street expects the company to report earnings of $2.27 per share for Q3, up 7% from the year-ago quarter. Meanwhile, analysts project Q3 revenues at $99.95 billion, up about 13% year-over-year.

Ahead of the company’s Q3 results, Stifel analyst Mark Kelley raised his price target on Alphabet to $292 from $222 and kept a Buy rating. The firm said its recent ad industry checks showed that Q3 growth improved from Q2, with September being the strongest month. However, Stifel cautioned that tough comparisons and ongoing macro or tariff concerns could limit excitement around Q4 guidance, even as the digital ads market stays healthy. The higher price target reflects a better valuation outlook and expectations of favorable antitrust outcomes for Google Search.

MSFT or GOOGL: Which Stock Offers Higher Upside, According to Analysts?

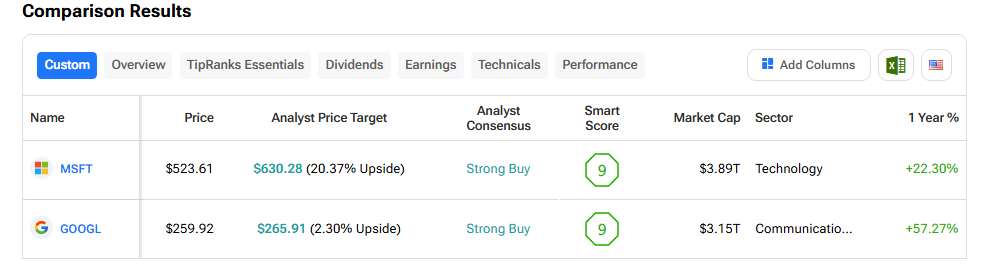

Using TipRanks’ Stock Comparison Tool, we compared Microsoft (MSFT) and Alphabet (GOOGL) to see which Magnificent Seven AI stock analysts favor. Both stocks carry a Strong Buy consensus and a Smart Score of 9. Microsoft trades near $523.61 with an average price target of $630.28, implying about 20% upside. Meanwhile, Alphabet trades around $259.92 with a price target of $265.91, suggesting about 2% upside.

Conclusion

Both Microsoft and Alphabet remain strong AI and cloud leaders heading into earnings week. However, based on Wall Street’s price targets, Microsoft offers higher upside potential, while Alphabet’s steady growth highlights its solid position in digital ads and AI integration.