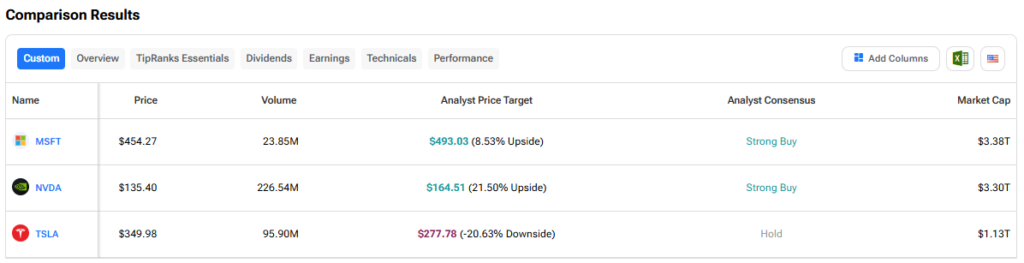

The easing of tariff wars and resilient results reported by several companies has helped revive investor sentiment, driving notable recovery in the Magnificent 7 stocks – Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA), over the past month. Using TipRanks’ Stock Comparison Tool, we will compare three Magnificent 7 stocks to pick the one that could offer the highest upside, according to Wall Street analysts.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Microsoft (NASDAQ:MSFT)

Microsoft stock is up about 8% year-to-date, thanks to the 22% rally over the past month, driven by the company’s impressive results for the third quarter of Fiscal 2025 and solid guidance. Notably, the tech giant’s Azure cloud business delivered 33% revenue growth in Q3 FY25, with 16 percentage points of that growth coming from AI (artificial intelligence).

The company is confident about the demand for its differentiated offerings. Management expects Microsoft’s capital expenditure to continue to grow in Fiscal 2026, but at a slower rate than this year.

Microsoft has been significantly investing in AI infrastructure to capture growth opportunities in the lucrative generative AI space. The company’s stellar results addressed investors’ concerns about Azure growth and AI demand.

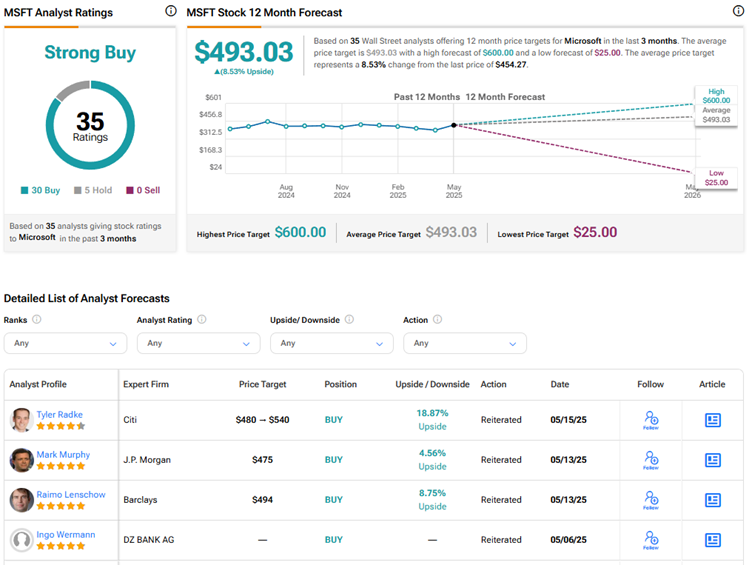

What Is the Price Target for MSFT Stock?

On May 15, Citi analyst Tyler Radke increased the price target for Microsoft stock to $540 from $480 and reiterated a Buy rating. The 4-star analyst updated his model following reports about the company’s job cuts and fiscal third-quarter results. Radke noted that management’s commentary on his callback and following the results indicated confidence about the demand environment and investment cycle, with the company reaffirming its capex growth guidance for Q4 FY25 and FY26.

Consequently, Radke raised Azure’s growth estimate back to 35% year-over-year (in constant currency) Q4 FY25 and more than 30% in FY26, with continued capex growth expected in FY26. The analyst expects MSFT’s job cuts to generate incremental net savings of more than $1 billion in FY26 and help offset the incremental depreciation and capex cost. Overall, Radke remains constructive on Microsoft’s leading position in generative AI.

On TipRanks, Microsoft stock scores a Strong Buy consensus rating based on 30 Buys and five Holds. The average MSFT stock price target of $493.03 implies 8.5% upside potential.

Nvidia (NASDAQ:NVDA)

Nvidia stock is essentially flat year-to-date after recovering 30% over the past month. The recovery in the semiconductor giant’s stock has been driven by easing tariff tensions, the Trump administration’s plans to roll back Biden-era export restrictions on AI chips, and the chip export deals with Saudi Arabia and the United Arab Emirates (UAE).

Looking ahead, Nvidia is scheduled to announce results for the first quarter of Fiscal 2025 on May 28. Most analysts remain bullish on the company’s growth potential, supported by the robust demand for the company’s GPUs (graphic processing units) in building and training AI models. In particular, they are confident about the demand for the company’s Blackwell platform.

Wall Street expects Nvidia’s Q1 FY26 EPS (earnings per share) to grow 46% to $0.89 and revenue to rise about 66% to $43.15 billion.

Is NVDA Stock a Strong Buy?

Heading into the results, Mizuho analyst Vijay Rakesh reaffirmed a Buy rating on Nvidia stock with a price target of $168. Rakesh expects mixed near-term earnings, but a solid outlook for the second half of the year. He expects the April consensus estimates for overall revenue of $43.2 billion and data center revenue of $39.2 billion to see some upside due to H20 sales, but projects weaker GB200 sales. Moreover, EPS is expected to be hit by the $5.5 billion write-down related to the H20 chip curbs previously disclosed by the company.

For the July quarter, Rakesh expects overall revenue and data center revenue of $46.6 billion and $42.5 billion, respectively. He sees the possibility of a $3 billion headwind related to H20 wind downs, but expects GB200 to start ramping with enhanced testing capacity. “While some moving parts paint a mixed picture for AprQ/JulQ, we see OctQ/JanQ STRONG as GB200 NVL72 ramps up along with GB200/300 HGX shipments,” said Rakesh. He expects GB300 NVL72 to likely ramp up in the first half of 2026.

With 34 Buys, five Holds, and one Sell recommendation, Nvidia stock scores a Strong Buy consensus rating on TipRanks. The average NVDA stock price target of $164.51 implies 21.5% upside potential from current levels.

Tesla (NASDAQ:TSLA)

Electric vehicle (EV) maker Tesla’s stock is down 13.3% year-to-date due to the company’s disappointing performance amid intense competition and price wars, tariff woes, and concerns about the impact of CEO Elon Musk’s political activities. However, TSLA stock has jumped about 45% over the past month, thanks to favorable trade agreements to mitigate tariff pressures, and Musk’s assurance that he will devote more time to the EV company.

Despite Tesla losing market share in key markets like Europe and China, investors are upbeat about the company due to its plans to launch affordable EV models to boost its sales and revive demand. Moreover, TSLA bulls are optimistic about the prospects of the company’s robotaxis.

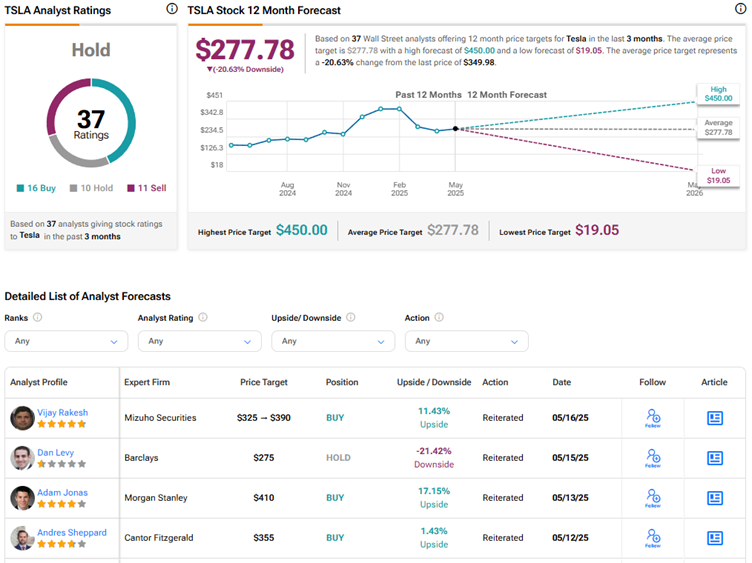

Is TSLA Stock a Buy, Sell, or Hold?

On May 16, Mizuho’s Rakesh increased the price target for Tesla stock to $390 from $325 and maintained a Buy rating. The 5-star analyst sees the U.S. rollback of China tariffs as a favorable development for macro demand and EV parts imports. However, Rakesh thinks that lower EV subsidies in the U.S. “are a challenge.”

Currently, Wall Street has a Hold consensus rating on Tesla stock based on 16 Buys, 10 Holds, and 11 Sell recommendations. The average TSLA stock price target of $277.78 implies about 21% downside risk from current levels.

Conclusion

Wall Street is highly bullish on Microsoft and Nvidia stocks but sidelined on Tesla stock. Analysts see higher upside potential in Nvidia stock than in the other two Magnificent 7 stocks. Despite concerns about tariffs and chip restrictions, analysts continue to believe in Nvidia’s growth potential, backed by robust demand for its advanced GPUs and continued innovation.