Popular hedge fund manager Cathie Wood is bullish on the prospects of tech giants Microsoft (NASDAQ:MSFT) and Meta Platforms (NASDAQ:META). Bloomberg reported that Wood’s ARK Next Generation Internet ETF (ARKW) boosted its stake in these two stocks to capitalize on the Artificial Intelligence (AI) boom.

Per the report, Ark Next Generation Internet ETF (Exchange-Traded Fund) bought 8,810 shares of Microsoft. Moreover, it purchased 10,212 shares of Meta Platforms. With these recent transactions, MSFT and META constitute 1.01% and 1.07% of ARKW’s overall portfolio, respectively. Investors can find detailed weight percentages for each holding on TipRanks’ holdings information page.

It’s worth noting that Wood has been focusing on alternative AI bets after missing the rally in Nvidia (NASDAQ:NVDA) stock. Wood reduced exposure to Nvidia stock in January this year, missing out on the remarkable upswing of NVDA stock. Nonetheless, MSFT and META are going all-in on AI, making them compelling investments to ride the AI wave.

With this background, let’s look at what the Street suggests for MSFT and META stocks.

What Do Analysts Say About Microsoft?

Along with Wood, analysts are also bullish about Microsoft’s prospects. MSFT’s AI endeavors are positively impacting its financials and stock price. The company is integrating AI across its offerings and launching new products to strengthen its competitive positioning and expand its market share in the cloud business.

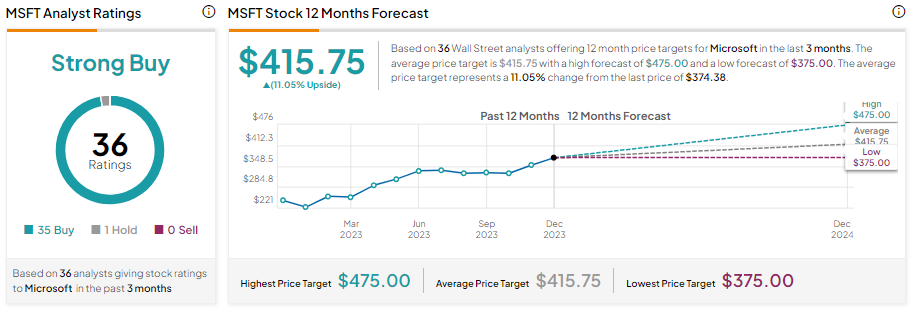

With 35 Buy and one Hold recommendations, MSFT stock has a Strong Buy consensus rating. Further, analysts’ average price target of $415.75 implies 11.05% upside potential from current levels.

What is the Prediction of META Stock?

Meta is investing in AI to drive user engagement and its financials. With the introduction of AI functionalities into its family of apps, Meta is resonating well with users. This is reflected in the increase in the number of individuals using its apps. Meta CEO Mark Zuckerberg said during the Q3 conference call that 3.9 billion people use at least one of its apps every month. On the other hand, Meta is leveraging AI to improve monetization.

META stock has 37 Buy and one Hold recommendations for a Strong Buy consensus rating. Further, the average META stock price target of $387.71 implies 16% upside potential from current levels.