Shares of Morgan Stanley (NYSE:MS) declined in pre-market trading despite the investment bank and financial services company delivering better-than-expected second-quarter results. The bank reported diluted earnings of $1.82 per share, up by 46.7% year-over-year, which beat analysts’ consensus estimate of $1.65 per share.

The bank clocked Q2 revenues of $15 billion, an increase of 11.6% year-over-year, which surpassed analysts’ expectations of $14.3 billion.

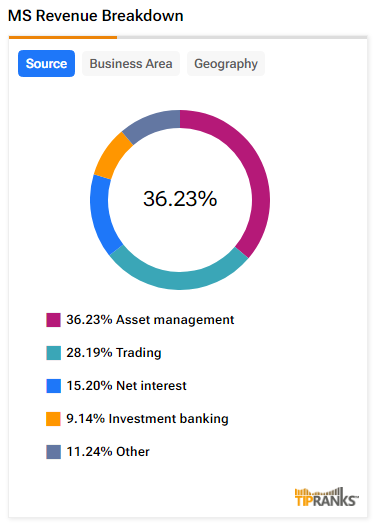

Morgan Stanley’s Revenue Breakdown

Morgan Stanley’s equity trading revenue increased 18% year-over-year to $3.02 billion, surpassing the estimate by $330 million. Equity trading revenue comprised more than 20% of MS’s total revenues of $15 billion in Q2.

The bank’s revenue from fixed-income trading grew 16% to $1.99 billion, beating Street forecasts by $130 million. Investment banking revenue surged 51% to $1.62 billion, exceeding Street expectations by $220 million. The surge in investment banking revenues was driven by higher fixed-income underwriting, especially from non-investment grade companies raising debt. Underwriting services are offered by large financial institutions like banks and insurance companies, where they guarantee payment in case of damage or loss and accept the financial risk from such guarantees.

Morgan Stanley’s Dividend and Stock Buyback

Furthermore, the company’s Board of Directors declared a quarterly dividend of $0.925 per share, an increase of 7.5 cents, payable on August 15 to shareholders of record on July 31, 2024.

The bank repurchased $0.8 billion worth of its outstanding common stock during the second quarter and reauthorized a stock buyback program spanning multiple years of up to $20 billion.

Is MS Stock a Good Buy?

Analysts remain cautiously optimistic about MS stock, with a Moderate Buy consensus rating based on seven Buys and eight Holds. Over the past year, MS has increased by more than 20%, and the average MS price target of $103.18 implies a downside potential of 1.98% from current levels. These analyst ratings are likely to change following MS’s Q2 results today.

Questions or Comments about the article? Write to editor@tipranks.com