Semiconductor giant Marvell Technology (NASDAQ:MRVL) stock dropped 4.4% in Thursday’s after-hours trading session following the release of fiscal first-quarter results. MRVL delivered earnings of $0.24 per share, which matched estimates, while revenues surpassed expectations.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

The company noted that weak consumer demand and lower IT spending by enterprises impacted its performance to some extent. Nevertheless, Marvell benefited from stronger-than-expected demand for its artificial intelligence (AI) offerings.

MRVL: Q1 Highlights

The company generated Q1 revenues of $1.16 billion and surpassed Street estimates of $1.15 billion. However, it reflects a decrease of 12% from the same quarter last year. Further, MRVL’s adjusted earnings declined by 22.5% year-over-year.

During the first quarter, the company’s businesses performed weakly except for the Data Center, which provides AI-related applications. Data Center revenue rose 87% year-over-year to $816.4 million.

Meanwhile, Consumer revenue declined 70% year-over-year to $42 million. Also, Carrier Infrastructure and Enterprise Networking revenues plunged by 75% and 58%, respectively. Automotive and Industrial segment revenue was down 13%.

Fiscal Q2 Outlook

For the fiscal second quarter, Marvell expects revenue in the range of $1.19 billion to $1.31 billion. Also, adjusted earnings are expected to come in between $0.24 and $0.34. Analysts are expecting revenues and earnings of $1.22 billion and $28, respectively.

What Is the Forecast for MRVL Stock?

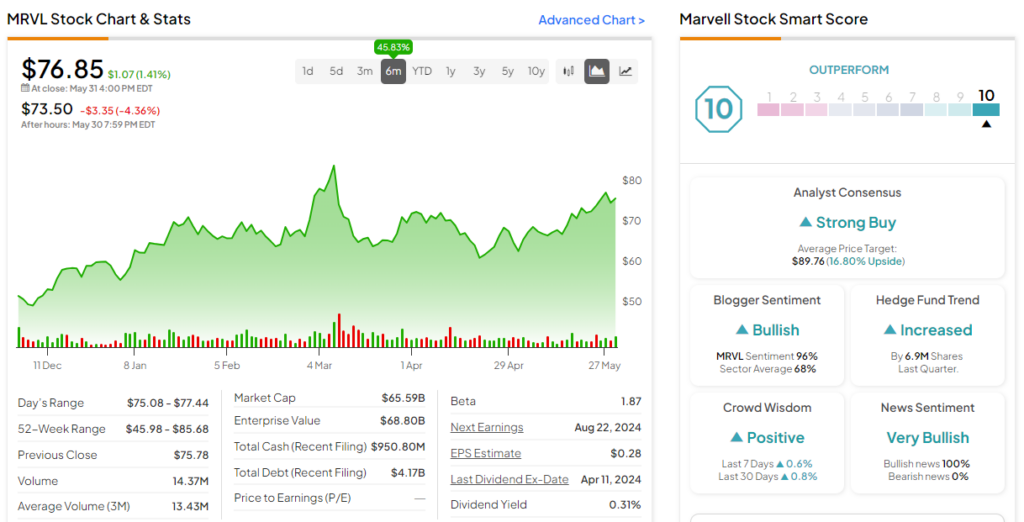

Overall, Marvell has a Strong Buy consensus rating based on 28 Buy and one Hold recommendations. The analysts’ average price target on MRVL stock of $89.76 implies an upside potential of 16.8% from current levels. Shares of the company have gained 45.8% in the past six months.

Importantly, MRVL sports a Smart Score of “Perfect 10” on TipRanks. It’s important to note that stocks with the “Perfect 10” score have historically surpassed the S&P 500 Index (SPX) by a significant margin.