It might surprise some investors caught up in the halo around the world of cerebral AI, but it is actually those muscle-pumping gold mining stocks which have outshone the competition this year.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Greatest Ever

According to analysts, a gauge of the world’s gold equities from MSCI Inc. has soared about 135% this year, tracking gains in the safe-haven precious metal. That means that it is on track for its greatest-ever outperformance versus the index compiler’s measure of major global semiconductor firms, such as Nvidia, (NVDA) which is up 40%.

The huge gap reveals that although investors have a heavy dose of FOMO when it comes to any stock related to AI, they are even more attracted by the relentless rally in gold.

“Gold and gold miners are one of my most bullish medium thematic calls,” said Anna Wu, a cross-asset investment strategist at Van Eck Associates Corp. in Sydney. Gold has safe haven appeal, “while gold miners are also set to benefit from margin expansion and valuation re-rating.”

The gold price has soared nearly 50% this year hitting new records and getting close to that magical $4,000 an ounce mark – see above.

Gold Drivers

It’s been driven by geopolitical fears from Ukraine to the Middle East, economic uncertainty sparked by President Trump’s tariffs strategy and central bank buying.

It has also been supported by the Federal Reserve cutting interest rates with the prospect of more to follow this year, a weaker pound and more private investors pouring cash into gold-backed exchange-traded funds.

The current U.S. government shutdown is also unsettling investors, making gold look even more attractive.

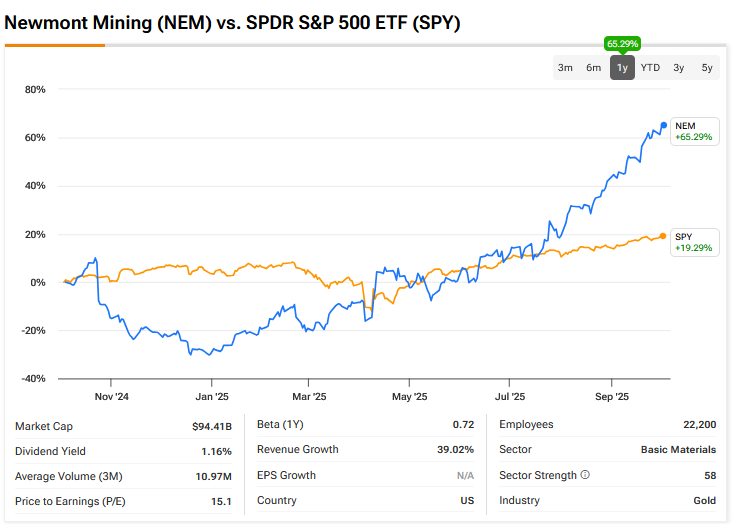

Among the heavyweights in MSCI’s gold miners index, Newmont Mining (NEM) – see below – and Agnico Eagle Mines (AEM) have seen their New York-listed stocks more than double in 2025. Zijin Mining Group Co.’s shares have jumped more than 130% in Hong Kong, outpacing gains in China’s AI darling Alibaba Group Holding (BABA).

In addition, valuations are slightly cooler in the mining sector compared with AI. The MSCI gold miner index trades at 13 times forward earnings estimates, slightly below its average for the last five years. In contrast, the chip gauge is at 29 times, well above its five-year average.

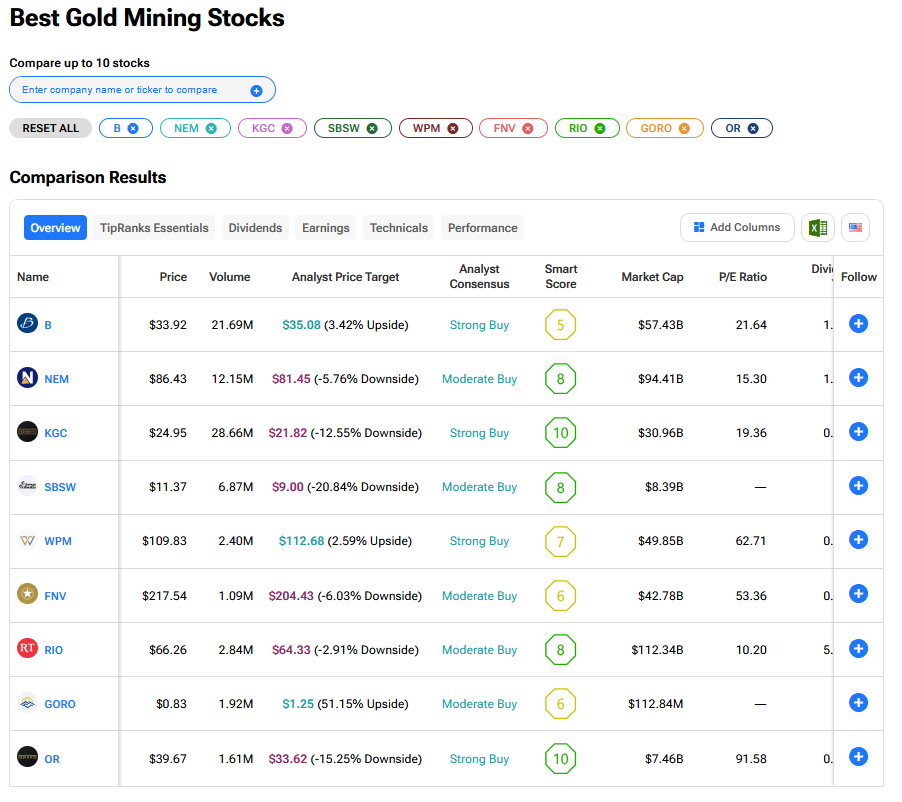

What are the Best Gold Mining Stocks to Buy Now?

We have rounded up the best gold mining stocks to buy now using our TipRanks comparison tool.