So yesterday, we noted that aerospace stock Boeing (BA) was ready to hit the Paris Air Show, and brought along plenty of attractions to catch the eyes and interest of airlines. And in the process, Boeing offered up its May sales numbers, most of which were already fairly well known. Investors found no reason to celebrate, and shares were down modestly in Tuesday afternoon’s trading.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Boeing pulled in a whopping 303 gross orders for the month of May, reports noted, which was the highest number of orders the company had seen since December 2023. And while that is a hefty dollop of orders, Boeing is also stepping up its production to actually get those orders filled in less time than it takes to have two Presidential elections in the United States. In fact, the 737 Max is now back up to 38 planes a month, which is the exact level the Federal Aviation Administration (FAA) capped Boeing at previously.

And Boeing is making deliveries as well, with 45 jets handed over in May. That is on par with the April total, reports note, but it also represents a major surge as Boeing only delivered half that number back in 2024. This year is also looking bright; factoring in canceled or converted orders, Boeing booked 512 orders so far this year. By comparison, Airbus (EADSY) pulled in 215. The Paris Air Show, meanwhile, starts up next week in earnest and will hopefully provide still more orders to come.

“The Chinese Need Planes Very Badly.”

Meanwhile, infamous market analyst Jim Cramer notes a point we have seen developing over the last several weeks: the Chinese need airplanes, and they need them rather urgently. Moreover, there are only so many places from which the Chinese can get these aircraft, and that means conversations with Boeing.

In fact, Cramer notes, Boeing could indeed prove to be the great negotiating tool that President Trump needs to deal with the Chinese. Those planes are vital, and not exactly fungible; they cannot just be ordered from elsewhere very readily, especially given how backed up Airbus itself was at last report. So this may give Trump the wedge he needs to make real change with the Chinese government.

Is Boeing a Good Stock to Buy Right Now?

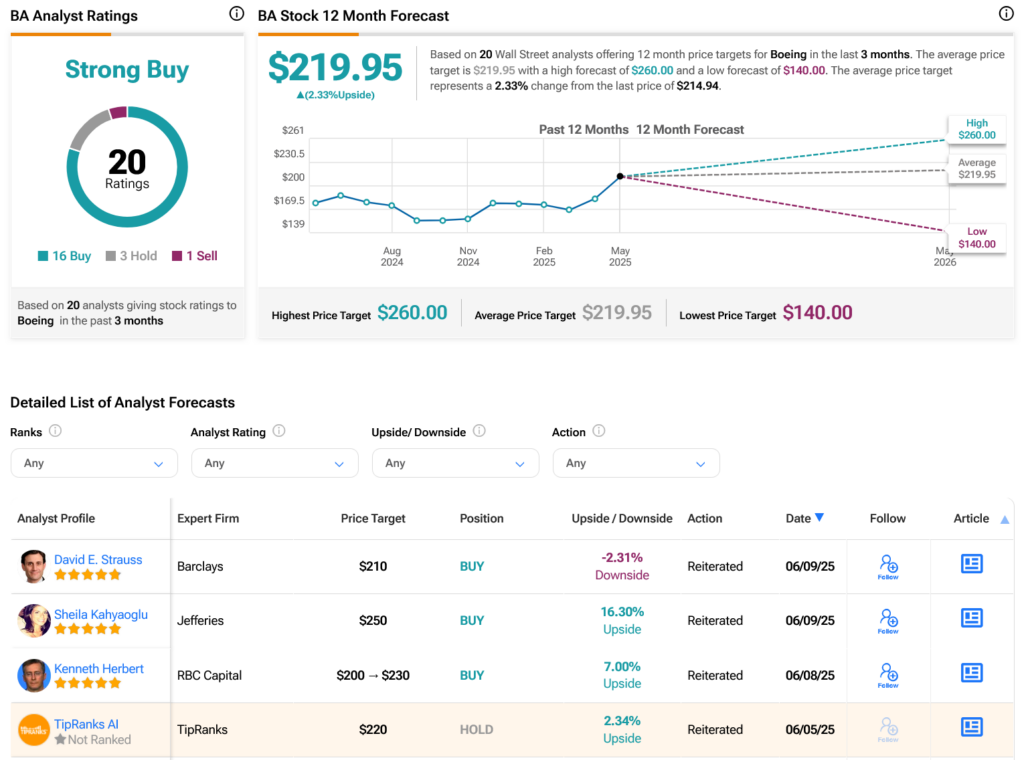

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 16 Buys, three Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 17.26% rally in its share price over the past year, the average BA price target of $219.95 per share implies 2.33% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue