Mike Wilson, Chief Investment Officer at Wall Street firm Morgan Stanley (MS), says that a weak U.S. dollar will support corporate earnings and keep the American stock market buoyant.

Specifically, Wilson wrote in a note to clients that, despite ongoing volatility, he expects that U.S. stocks will continue to outperform equities in other markets around the world. Wilson’s view is in contrast to many other Wall Street strategists who are predicting the end of U.S. outperformance.

However, Wilson wrote that U.S. stocks remain a better relative bet than securities in other regions of the world because of less volatile earnings and the fact that American companies are deemed to have higher quality businesses relative to their foreign peers.

Continued Outperformance

In his note to clients, Wilson wrote that, “We remain in a late cycle backdrop where both quality and large-cap relative outperformance should continue.” The Chief U.S. Equity Strategist said he expects the S&P 500 to remain in the 5,000 to 5,500 point range. Any rise above the 5,500 level will likely require a tariff deal with China and easier monetary policy from the U.S. Federal Reserve.

Wilson’s optimism stands in contrast to many other banks on Wall Street. JPMorgan Chase (JPM) just issued a note saying it favors international stocks over U.S. ones as the risk-reward set-up is better. In recent days, Bank of America (BAC) urged investors to sell into U.S. stock rallies and hideout in bonds and gold until market conditions improve and volatility subsides.

MS stock has declined 7% this year.

Is MS Stock a Buy?

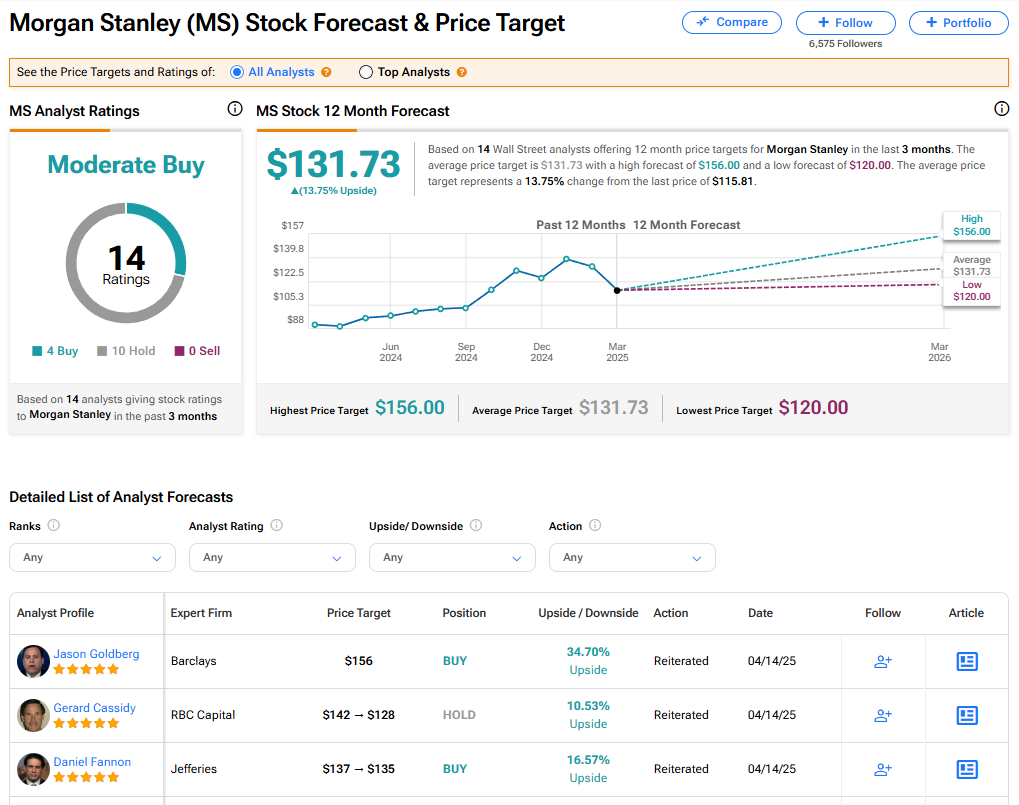

The stock of Morgan Stanley has a consensus Moderate Buy rating among 14 Wall Street analysts. That rating is based on four Buy and 10 Hold recommendations assigned in the last three months. The average MS price target of $131.73 implies 13.75% upside from current levels.