Tesla (NASDAQ:TSLA) bulls have long stood firm against waves of skepticism, but recent woes have sparked some doubts about the company’s current trajectory, even among some of the camp’s most bullish members.

This brings us to Morgan Stanley analyst Adam Jonas, a Tesla bull who has consistently banged the drum for the EV leader. However, Jonas now thinks it is time to temper near-term expectations.

Following a slew of data that has pointed to crushing sales across the globe, Jonas has reduced his auto deliveries forecast for both the first quarter and the full year. The analyst now expects 1Q25 deliveries will hit 351k, amounting to a 9.3% year-over-year drop vs. 415k (+7.3% y/y) beforehand. Additionally, Jonas now sees FY25 deliveries at 1,615k (a 9.8% y/y decline) down from the prior expectation of 1,924k (+7.5% y/y).

Jonas cites factors such as increased competition, an aging vehicle lineup, a buyers’ strike caused by negative brand sentiment, and the upcoming release of new products as the reasons behind the lowered expectations.

The downward revisions don’t end there. Jonas also lowered his FY25 revenue forecast from $105.1 billion to $94.5 billion, while the auto gross margin ex credits is brought down to 14.4% from 15.9%. Additionally, Jonas lowered his adj. EPS estimate from $2.70 to $2.18.

So, no great news there. That said, for those thinking Jonas might be crossing over from the bull camp to the bear enclave, that is not the case. The analyst thinks the lower expected delivery haul is “not particularly narrative changing for our investment thesis.” That’s because Jonas finds the silver lining in the soft numbers.

“In our view, Tesla’s softer auto deliveries are emblematic of a company in the transition from an automotive ‘pure play’ to a highly diversified play on AI and robotics,” the analyst opined.

And as AI transitions from the digital realm (bits and bytes) to the physical realm (atoms and photons), Jonas anticipates that Tesla’s total addressable market will continue to grow into new areas, many of which are currently not reflected in analysts’ financial models.

“While the journey may be volatile and non-linear, we believe 2025 will be a year in which investors will continue to appreciate and value these existing and nascent industries of embodied AI where we believe Tesla has established a material competitive advantage,” the analyst summed up.

Despite trimming his price target from $430 to $410, Jonas remains optimistic, retaining an Overweight (i.e., Buy) rating on Tesla shares and highlighting them as a Top Pick. With a potential upside of 73.5% from current levels, he believes Tesla’s future, though it may encounter some bumps, holds considerable promise. (To watch Jonas’ track record, click here)

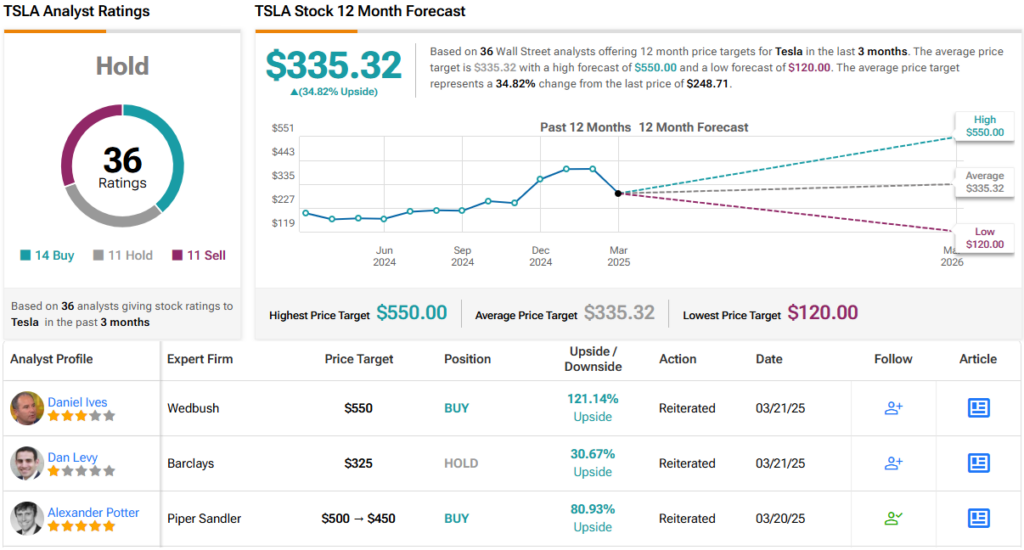

13 other analysts also keep an optimistic stance on TSLA, yet with an additional 11 Holds and Sells, each, the stock only claims a Hold consensus rating. Still, the average target stands at $335.32, implying the shares will gain ~35% in the months ahead. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Questions or Comments about the article? Write to editor@tipranks.com