Tesla (NASDAQ:TSLA) stock has pushed the gas after stalling earlier this year. Despite still being down 15% year-to-date, shares have surged 51% since hitting a low on April 21 – the comeback, forgive the puns, is clearly in drive.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

The rally has been fueled by easing trade tensions, beginning with Trump’s reversal on sweeping global tariffs and followed by a 90-day suspension of mutual duties between the U.S. and China as trade talks take place.

According to Morgan Stanley analyst Adam Jonas, it’s no surprise that auto stocks have “understandably reacted favorably” to de-escalation of the tariff war between the world’s two superpowers following the Geneva trade talks. But more than that, Jonas thinks the entente could open up the door for further cooperation.

“We would not be surprised to see significant areas of cooperation between US and Chinese manufacturing firms involving Chinese-based technology manufactured on US shores,” Jonas said.

In particular, Jonas believes China could play a pivotal role in shaping how the U.S. approaches physical AI, a sector where advanced manufacturing meets robotics, and one where China currently has a leg up. While rivalry tends to fuel innovation, Jonas argues that when it comes to physical AI, collaboration may be the smarter path. From Jonas’ conversations with auto executives, it’s clear that pulling off a successful re-shoring strategy in the U.S. over the next five years would be extremely tough if steep tariffs are placed on key Chinese components.

In talks with management teams, Jonas says he hasn’t come across a single Western auto CEO who believes that tariffs or trade barriers will ultimately stop U.S. consumers from gaining access to advanced Chinese EV technology. From an automotive standpoint, Jonas expect U.S.-China relations to gradually improve from where they are today. That said, Jonas also anticipates ongoing tensions around sensitive issues like data capture and computing power.

So, where does Tesla enter the picture here? The analyst explains: “While there may be several US auto-related firms that could help accelerate a cooperative on-ramp of China manufacturing tech, we believe Tesla may be uniquely positioned here.” He adds that a more collaborative and open trade relationship between the U.S. and China could help accelerate Tesla’s transition to its next phase – moving beyond simply selling human-driven electric vehicles.

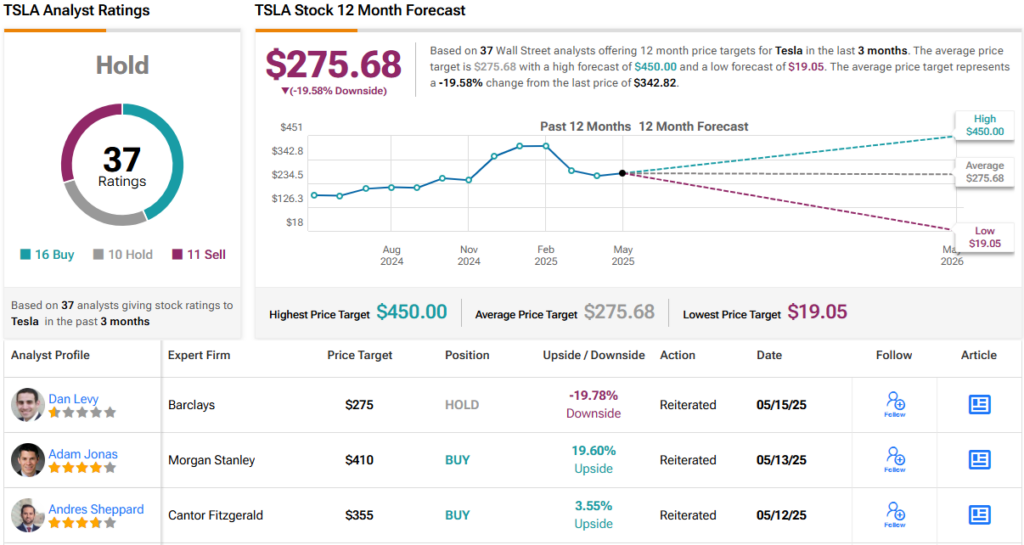

All told, Tesla remains Jonas’ top pick among U.S. auto stocks. The Morgan Stanley analyst is holding firm on his Overweight (i.e., Buy) rating and a $410 price target, pointing to potential gains of ~20% from where the stock currently trades. (To watch Jonas’ track record, click here)

The Street’s overall take is less exuberant; TSLA gets a lukewarm Hold consensus rating, based on a mix of 16 Buys, 10 Holds and 11 Sells. Meanwhile, the $275.68 average price target implies a potential downside of around 20% over the next 12 months. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.