To the surprise of exactly no one, Nvidia (NASDAQ:NVDA) reported blowout results on Wednesday evening, sending its stock flying more than 16% higher on Thursday. This propelled the stock’s year-to-date performance to a whopping 60% surge.

And surprising or no, the Q4 2023 numbers Nvidia reported quite simply boggle the mind:

- Sales roared ahead 265% year over year, to $22.1 billion.

- Data center sales – the unit that houses the AI chips production – in particular surged 409%.

- Adjusted profits were up 486% year over year.

- And GAAP profits did even better, rising 765% to $4.93 per diluted share.

Morgan Stanley analyst Joseph Moore, who was already feeling pretty optimistic about Nvidia stock before the earnings news, came away even more so, reiterating his “overweight” rating (i.e. buy) on Nvidia, and raising his price target from $750 to $795 a share. (To watch Moore’s track record, click here)

What did he like about the report, specifically?

AI demand remains “remarkable,” enthused the analyst, with Nvidia reporting $4.5 billion more data center revenue than even Nvidia itself had predicted was possible. Granted, heading into the report, Moore was already thinking that Nvidia’s predictions were too low, leading him to revise his own forecast “sharply” upward just a few weeks ago. But then Nvidia went and beat even his revised forecast.

And we’re not just talking about better sales numbers. As Moore points out, Nvidia also “upsided” its gross profit margin on those sales (so more revenue dollars, and also more profit pennies squeezed out of each such dollar). In total, Nvidia managed to earn gross profit margins of 76% in Q4 2023, and incredible 1270 basis point improvement over just one year ago.

What’s more, this doesn’t appear to be some kind of flash in the pan. Commenting on how things are looking in the AI semiconductor market, Nvidia advised that “demand will be well above supply by a material amount” in the coming year. And as any student of economics can tell you, when demand rises faster than supply, prices – and profit margins – just keep going higher.

The fact that Nvidia is saying its supply of H100 AI chips is already “allocated” (i.e. preorders are waiting to be filled) “supply through end of life” of that line of chips, while supplies of the upcoming B100 chip are already “sold out for several quarters” just reinforces the view that there’s a huge supply crunch in progress here, while demand continues unabated.

Unsurprisingly then, Nvidia’s guidance for the first quarter of 2024 already underway looks very strong indeed. Sales are forecast at $24 billion (and Moore thinks they’ll even be a little stronger than that). Gross profit margins, already well into the stratosphere, are only going to get more stratospheric, growing from 76% in Q4 2023 to 77% in Q1 2024. And the fact that most Wall Street analysts are only forecasting $21.4 billion in Q1 sales, and less than 75% gross profit margins, means it’s looking all but certain that Nvidia is going to beat earnings once again three months from now.

Skeptics can argue all they want, that good news like this cannot last forever. But for now at least, it does seem like Nvidia’s good news is going to last for at least another quarter.

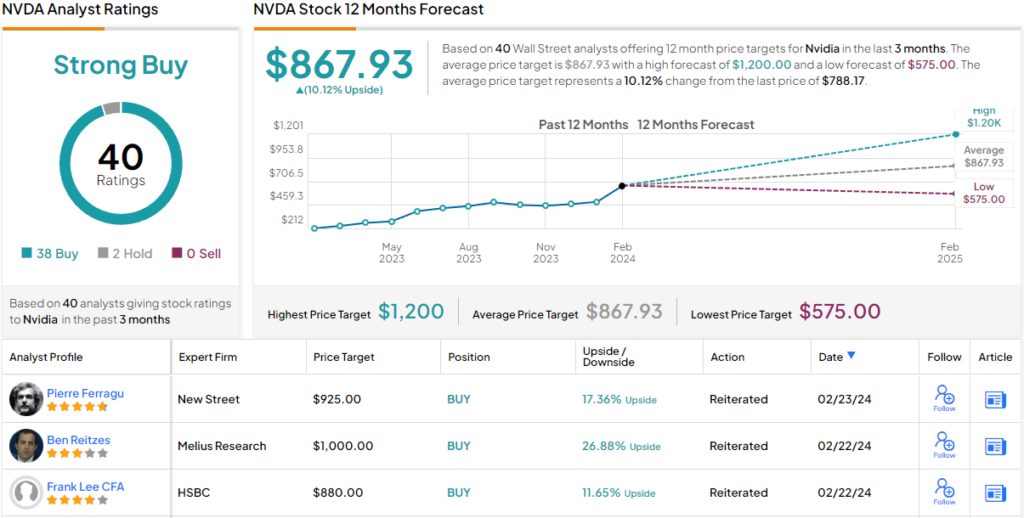

Like the Morgan Stanley analyst, the rest of the Street is bullish on NVDA. 38 Buy ratings compared to only 2 Holds add up to a Strong Buy consensus rating. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.