Tesla (TSLA) just got a fresh boost from Wall Street, as Morgan Stanley reaffirmed its bullish stance on the EV giant. Yesterday, four-star-rated analyst Adam Jonas maintained his Buy rating and $410 price target, citing confidence in Tesla’s long-term growth story. With renewed investor interest and a sharp focus from CEO Elon Musk, Tesla’s momentum appears to be revving back up.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Morgan Stanley Cites Supply Chain Strength Amid Headwinds

In his latest note, Jonas highlighted Tesla’s ability to navigate short-term supply challenges and maintain a strong foothold in the EV market.

However, he pointed out a potential risk. Tesla utilizes advanced technology, including permanent magnets, which rely on rare earth materials primarily sourced from China. With China tightening export controls on these materials, Tesla could face future supply chain disruptions.

Nonetheless, Jonas highlighted the company’s proactive strategy, which includes collaborating with Chinese authorities to obtain necessary export permits, sourcing alternative suppliers, and increasing investment in domestic lithium iron phosphate (LFP) battery production. These initiatives reflect Tesla’s commitment to securing its supply chain and reducing long-term material risks.

What’s Behind TSLA’s Recent Rally?

Tesla stock has surged more than 25% over the past month, with the rally kicking off after its Q1 earnings report. While the results fell short of expectations, investor confidence was boosted by Tesla’s commitment to launching a more affordable vehicle and rolling out its much-anticipated robotaxi service, set to debut in Austin, Texas, this June.

Yesterday, Tesla shares gained nearly 7% after Musk announced he’s refocusing his attention on Tesla and X. Investors welcomed the news, as Musk’s renewed hands-on approach could boost confidence in Tesla’s core businesses while helping to ease reputational concerns tied to platform disruptions and political controversy.

What Is the Target Price for Tesla Stock?

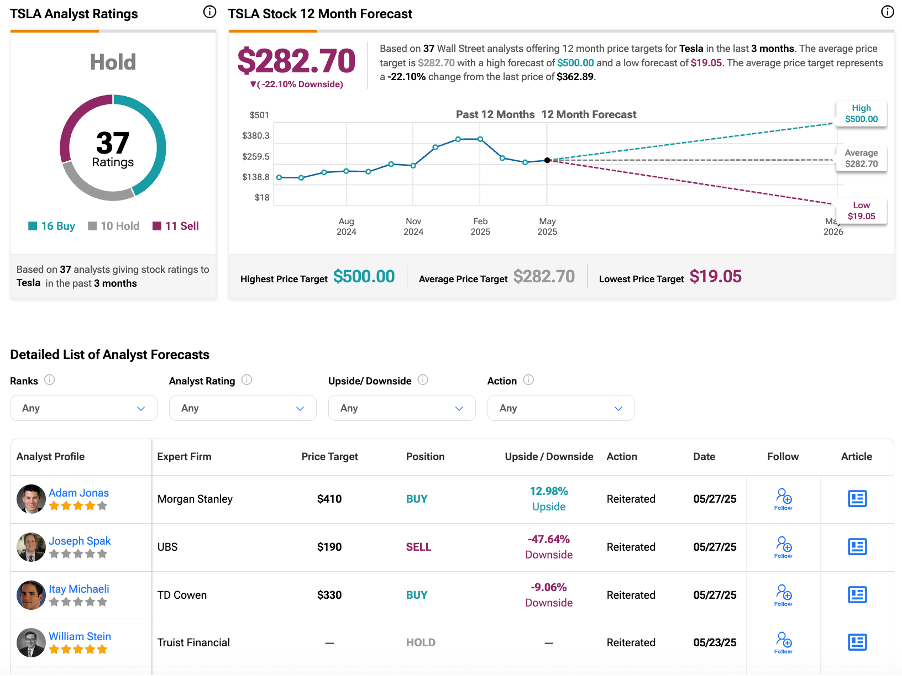

On Wall Street, analysts have maintained a neutral stance on Tesla stock. According to TipRanks, TSLA stock has received a Hold consensus rating, with 16 Buys, 10 Holds, and 11 Sells assigned in the last three months. The average Tesla stock price target is $282.70, suggesting a potential downside of 22% from the current level.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue