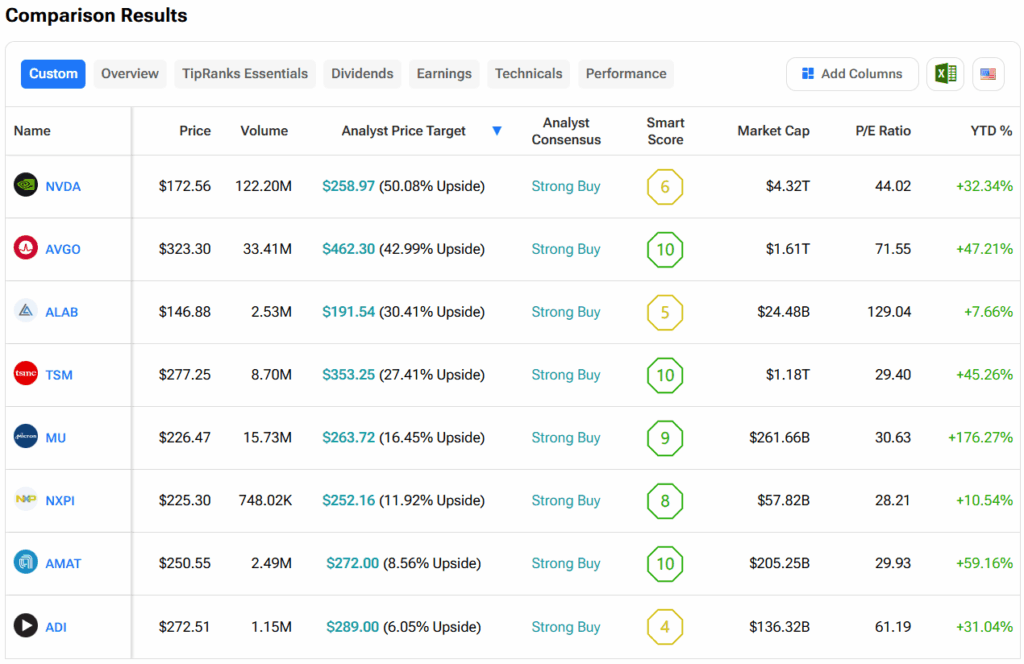

Investment firm Morgan Stanley (MS) has listed Nvidia (NVDA), Broadcom (AVGO), and Astera Labs (ALAB) as its top semiconductor stock picks for 2026. In a new research note, analysts said that the AI chip sector remains the most important area of focus for the third year in a row. They noted that demand for computing power continues to grow quickly, but they’re skeptical about long-term projections that suggest 2025’s performance will soon look small by comparison. While they agree the future looks strong, they believe the industry will likely face periods of slower growth along the way.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nevertheless, Nvidia and Broadcom are Morgan Stanley’s favorite processor stocks. Although analysts see increasing interest in custom ASIC chips, they still believe that Nvidia offers the best return on investment, especially as its Vera Rubin platform scales up in the second half of 2026. They also think that the market continues to undervalue Nvidia’s role in cloud computing. Separately, when it comes to smaller companies, Astera Labs stands out as the top pick for data center exposure.

Outside of processors, Morgan Stanley expects strong AI demand to keep memory and chip supplies tight. In memory, Micron (MU) is their top choice. In the chip equipment sector, they’re most optimistic about Applied Materials (AMAT) and Taiwan Semiconductor (TSM). As for analog chips, the outlook is slowly improving. Morgan Stanley prefers NXP Semiconductors (NXPI) for its strong balance of growth and value, while noting that Analog Devices (ADI) also has solid growth potential, though it currently trades at a higher price.

Which Chip Stock Is the Better Buy?

Turning to Wall Street, out of the chip stocks mentioned above, analysts think that Nvidia stock has the most room to run. In fact, Nvidia’s average price target of $258.97 per share implies more than 50% upside potential.