Microsoft (NASDAQ:MSFT) isn’t just another tech firm chasing the AI wave – it helped create it. As the driving force behind the integration of OpenAI’s technology into mainstream enterprise and consumer products, Microsoft continues to define the direction of the AI era.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That leadership position is exactly what Morgan Stanley’s Keith Weiss, an analyst ranked among the top 4% of Street stock experts, reaffirmed following the banking giant’s third-quarter CIO survey.

“Microsoft remains best positioned to capture incremental share of GenAI spend and IT budgets as workloads move to the cloud,” the 5-star analyst said.

The 3Q25 CIO survey shows that expectations for 2025 IT budget growth remain steady at 3.6%, roughly in line with previous levels. Software continues to lead as the fastest-growing sector, expected to rise by 3.8% in 2025. Early indications for 2026 suggest a modest uptick in overall IT budget growth – up 21 basis points year-over-year to 3.8%. While this reflects a positive trend, it still falls slightly below the survey’s 10-year average of 4.1%. By sector, CIOs anticipate Software will once again be the fastest-growing area in 2026, accelerating by 15 basis points y/yto 3.9%.

That backdrop provides fertile ground for AI-related investment. Artificial Intelligence and Machine Learning continue to rank highest on CIOs’ priority lists, with hyperscalers still seen as the preferred partners to help drive deployments of GenAI, large language models, and other emerging technologies. Microsoft, in particular, continues to hold a leading position, supported by several factors: its strong connection to “key secular themes” and CIO priorities, extensive integration across the software ecosystem, a wide range of products that enable monetization of Generative AI across its portfolio and user base, and substantial, growing investments in AI infrastructure.

The evidence is in the numbers. Microsoft Teams, Planner, Project, and Loop remain the most widely used tools for project and task management, which is “unsurprising given the ubiquity of Microsoft tools.” In 3Q25, 62% of CIOs reported using Microsoft Teams or Planner within their organizations, up from 55% in 3Q24. Meanwhile, 36% noted usage of Microsoft Project or another Microsoft solution, a slight dip from 39% a year earlier. Additionally, 61% of CIOs said their company is currently standardized on a single project management platform, up from 55% in 3Q24, with another 14% planning to standardize within the next year. Microsoft remains the “most likely choice,” with 32% of CIOs reporting their organization is standardized on one of its tools, up modestly from 31%.

That same momentum extends to AI budgets. Microsoft continues to be the primary beneficiary of additional GenAI spending in 2025 and over the next three years. In 2025, 33% of CIOs expect Microsoft to capture the largest incremental share of GenAI investment, compared with the next closest vendor at 14%. Over the next three years, 37% of CIOs anticipate Microsoft will claim the biggest incremental share, with the nearest competitor at 12%.

“Bottom line,” said Weiss, “Microsoft again remains the clearest beneficiary of GenAI spend, further supporting our view that the decision to pass on the recent $300 billion OpenAI contract will likely be proven correct longer-term.”

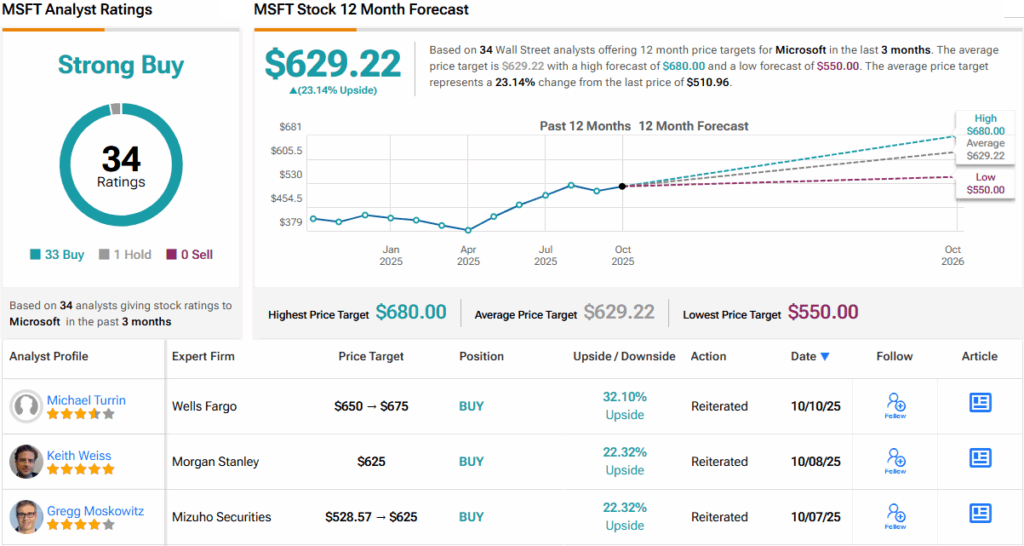

Accordingly, Weiss assigns MSFT stock an Overweight (i.e., Buy) rating. The analyst’s price target stands at $625, a figure that points toward one-year gains of 22%. (To watch Weiss’ track record, click here)

Barring one analyst who remains on the MSFT sidelines for now, all 33 other recent reviews are positive, making the consensus view here a Strong Buy. Going by the $629.22 average price target, a year from now, shares will be changing hands for a 23% premium. (See MSFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.