U.S. investment bank Morgan Stanley (MS) plans to offer trading in cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) through its E-Trade platform.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Crypto trading is expected to be available on E-Trade next year. Morgan Stanley has partnered with startup company Zerohash for liquidity, custody, and settlement around crypto trading, according to the Wall Street bank.

“We are well underway in preparing to offer crypto trading through a partner model to E-Trade clients in the first half of 2026,” wrote Morgan Stanley in a memo to staff that has been obtained by media outlets. The bank adds that it is embracing cryptocurrencies after the U.S. government’s stance towards digital assets improved with the re-election of President Donald Trump.

Wealth Management

Morgan Stanley is hoping to eventually integrate crypto into its wealth management offerings. Wealth management accounts for nearly half of Morgan Stanley’s annual revenue, making it more reliant on high net worth clients than other banks on Wall Street.

Morgan Stanley previously offered Bitcoin funds to its wealthy clients. But now, Morgan Stanley is preparing to offer direct ownership of cryptocurrencies such as Bitcoin and Ethereum to clients, which eliminates third-party management fees and comes with greater risks. Morgan Stanley says it will initially offer Bitcoin, Ethereum, and Solana (SOL) trading on E-Trade.

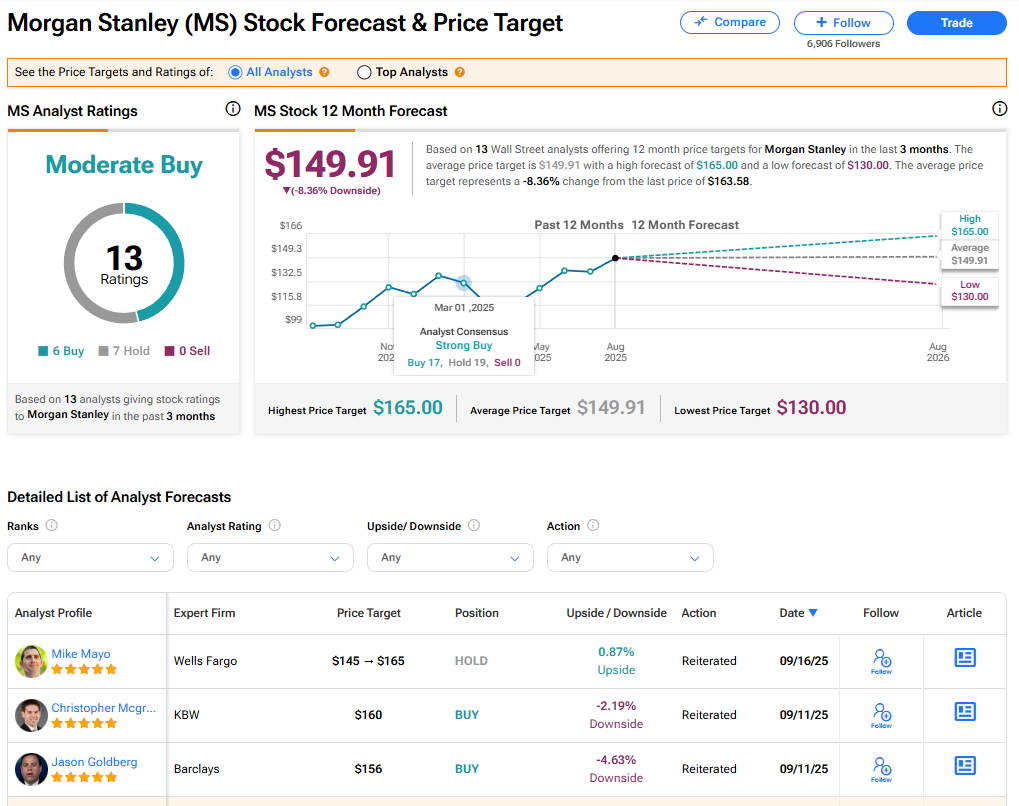

Is MS Stock a Buy?

The stock of Morgan Stanley has a consensus Moderate Buy rating among 13 Wall Street analysts. That rating is based on six Buy and seven Hold recommendations issued in the last three months. The average MS price target of $149.91 implies 8.36% downside from current levels.